Experian 2012 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

123

Governance Financial statementsBusiness reviewBusiness overview

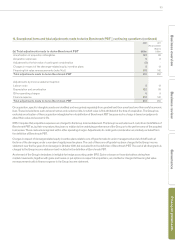

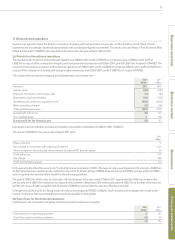

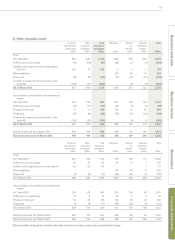

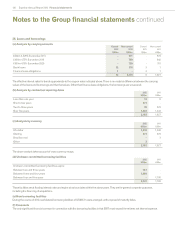

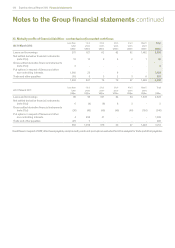

23. Investments in associates

2012

US$m

2011

US$m

Cost

At 1 April 27 243

Differences on exchange -1

Additions through business combinations (note 41) 11 -

Share of (loss)/profit after tax (including a profit of US$5m in 2011 in respect of FARES) (2) 3

Dividends received (including US$2m in 2011 in respect of FARES) (1) (3)

Acquisition of controlling stake in associate (22) -

Disposal of interest in FARES -(217)

At 31 March 13 27

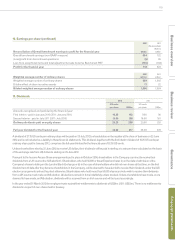

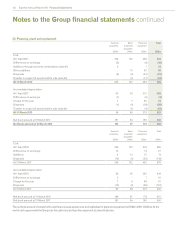

24. Inventories

2012

US$m

2011

US$m

Work in progress 2 -

Finished goods 9 14

11 14

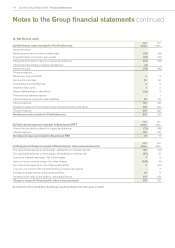

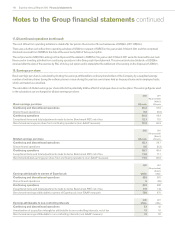

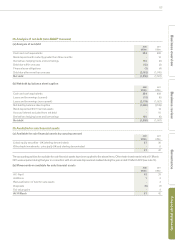

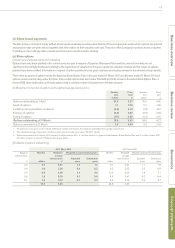

25. Trade and other receivables

(a) Analysis of trade and other receivables

Current

2012

US$m

Non-current

2012

US$m

Current

2011

US$m

Non-current

2011

US$m

Trade receivables 684 - 668 -

Provision for impairment of trade receivables (37) - (47) -

Other provisions in respect of trade receivables - mainly credit note provisions (25) - (16) -

Trade receivables - net 622 - 605 -

Amounts owed by associates 7 - 4 -

VAT recoverable 2 - 2 -

Other prepayments and accrued income 279 13 290 17

910 13 901 17

The accounting policies for loans and receivables have been applied to financial instruments of US$698m (2011: US$679m) within the above

items. VAT recoverable of US$2m (2011: US$2m) and prepayments of US$223m (2011: US$237m) are not regarded as financial instruments.

There is no material difference between the fair value of trade and other receivables and the book value stated above. All non-current

receivables are due within five years from the balance sheet date.

Amounts owed by associates are unsecured and settled in cash. No guarantees have been given or received in the year in connection with the

Group’s trading with such entities. No provisions have been made for doubtful debts in respect of such amounts.