Experian 2012 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164

|

|

115

Governance Financial statementsBusiness reviewBusiness overview

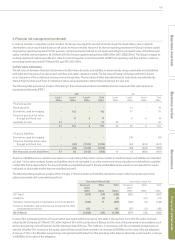

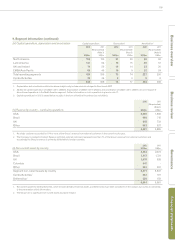

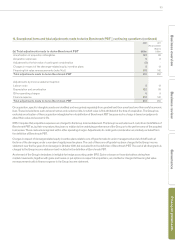

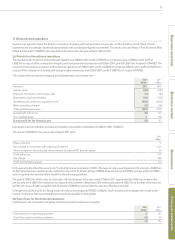

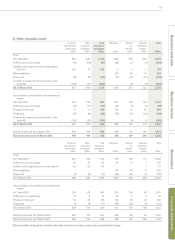

15. Tax (credit)/charge in the Group income statement

(a) Analysis of Group tax (credit)/charge

2012

US$m

20 11

(Re-presented)

(Note 3)

US$m

Current tax:

Tax on income for the year 120 91

Adjustments in respect of prior years (71) (35)

Total current tax charge 49 56

Deferred tax:

Origination and reversal of temporary differences (82) 49

Adjustments in respect of prior years (2) 13

Total deferred tax (credit)/charge (84) 62

Group tax (credit)/charge (35) 118

The Group tax (credit)/charge comprises:

UK tax (241) (23)

Non-UK tax 206 141

Group tax (credit)/charge (35) 118

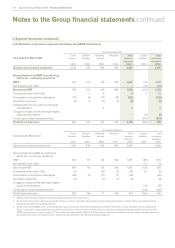

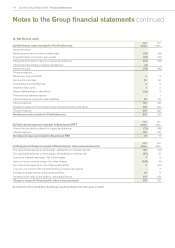

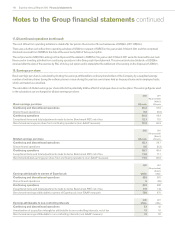

(b) Tax reconciliations

(i) Reconciliation of the Group tax (credit)/charge

2012

US$m

20 11

(Re-presented)

(Note 3)

US$m

Profit before tax 689 656

Profit before tax multiplied by the standard rate of UK corporation tax of 26% (2011: 28%) 179 184

Effects of:

Adjustments in respect of prior years (73) (22)

Income not taxable (42) (23)

Expenses not deductible 139 72

Adjustment in respect of previously unrecognised tax losses (217) (58)

Reduction in future rate of UK corporation tax 910

Effect of different tax rates in non-UK businesses (30) (45)

Group tax (credit)/charge (35) 118

Effective rate of tax based on Profit before tax (5.1%) 18.0%

The effective tax rate for both years is lower than the standard rate of UK corporation tax and the differences are explained above.