Experian 2012 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

145

Governance Financial statementsBusiness reviewBusiness overview

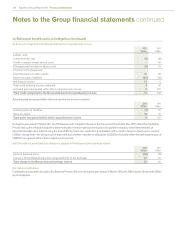

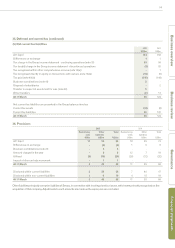

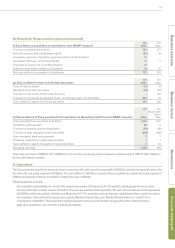

40. Notes to the Group cash flow statement (continued)

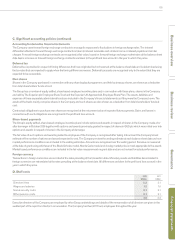

(f) Cash flows on acquisition of subsidiaries (non-GAAP measure)

2012

US$m

2011

US$m

Purchase of subsidiaries (note 41) 785 277

Net cash acquired with subsidiaries (note 41) (53) (6)

Acquisition expenses - transaction expenses paid on behalf of vendors 18 -

Acquisition expenses - other amounts paid 11 5

Payments to acquire non-controlling interests 12 -

Deferred consideration settled on acquisitions 14 25

Net cash outflow for acquisition of subsidiaries 787 301

(g) Cash outflow in respect of net share purchases

2012

US$m

2011

US$m

Issue of ordinary shares (11) (7)

Receipt of share option proceeds (54) (50)

Purchase of own shares held as treasury shares - 336

Purchase of own shares by employee trusts - for employee share incentive plans 232 70

Cash outflow in respect of net share purchases 167 349

(h) Reconciliation of Cash generated from operations to Operating cash flow (non-GAAP measure)

2012

US$m

20 11

(Re-presented)

(Note 3)

US$m

Cash generated from operations (note 40(a)) 1,539 1,311

Acquisition expenses paid 29 5

Purchase of property, plant and equipment (84) (69)

Purchase of other intangible assets (note 40(e)) (369) (300)

Sale of property, plant and equipment 37

Dividends received from continuing associates 1 1

Cash outflow in respect of exceptional items (note 40(c)) 5 20

Operating cash flow 1,124 975

There were cash flows of US$84m (2011: US$69m) for the purchase of property, plant and equipment after receipts of US$11m (2011: US$nil) in

the form of landlord incentives.

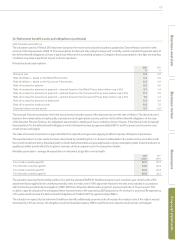

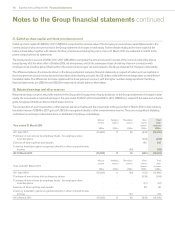

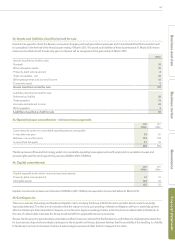

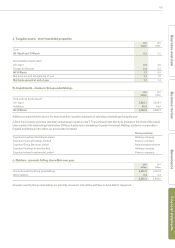

41. Acquisitions

The Group made ten acquisitions during the year, in connection with which provisional goodwill of US$553m has been recognised based on the

fair value of the net assets acquired of US$282m. The cash outflow of US$746m in respect of these acquisitions is stated net of cash acquired of

US$53m and includes deferred consideration settled in the year of US$14m.

These transactions included:

–the acquisition of substantially the whole of the issued share capital of Computec S.A. (‘Computec’), a leading Latin American credit

services information provider, based in Colombia. The purchase involved a delisting tender offer and cash consideration for the equivalent

of US$380m which was settled in October and November 2011. This acquisition extends Experian’s global leadership in credit information.

–the acquisition of the whole of the issued share capital of Medical Present Value, Inc (‘Medical Present Value’) on 1 July 2011 for a

consideration of US$192m. This acquisition broadens Experian’s presence in the healthcare payments sector in North America.

–eight other acquisitions, none of which is individually material.