Experian 2012 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42 Experian Annual Report 2012 Business review

Group balance sheet commentary

An analysis of net assets and capital

employed is given in the net assets summary

table. As part of the internal reporting

process, capital employed is monitored by

operating segment and further information

by operating segment is given in note 9(b)

to the Group financial statements. Capital

employed includes net pension assets of

US$77m (2011: US$55m) and net derivative

financial assets of US$92m (2011: liabilities of

US$13m).

The increase in Group total equity of

US$224m for the year includes actuarial

gains of US$7m in respect of defined

benefit pension plans and is after currency

translation losses of US$64m, mainly as a

result of the weakening of the Brazilian real

against the US dollar. These items are shown

net of related tax in the Group statement of

comprehensive income.

The share price of Experian ranged from

a low of £6.65 to a high of £9.96 during the

year. On 31 March 2012, the mid-market price

was £9.75, giving a market capitalisation of

US$15.4bn at that date (2011: US$12.7bn).

Financial review continued

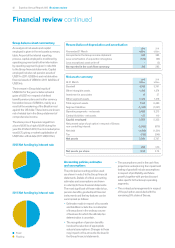

2012 Net funding by interest rate

2011 Net funding by interest rate

Fixed

Floating

Reconciliation of depreciation and amortisation

Year ended 31 March

2012

US$m

2011

US$m

As reported in the Group income statement 434 385

Less: amortisation of acquisition intangibles (122) (99)

Less: exceptional asset write-off -(3)

As reported in the cash flow summary 312 283

Net assets summary

At 31 March

2012

US$m

2011

US$m

Goodwill 4,163 3,761

Other intangible assets 1,582 1,374

Investment in associates 13 27

Other segment assets 1,426 1,318

Total segment assets 7,184 6,480

Segment liabilities (1,332) (1,267)

Operating segments - net assets 5,852 5,213

Central Activities - net assets 127 110

Capital employed 5,979 5,323

Net present value of put option in respect of Serasa

non-controlling interest (1,092) (870)

Net debt (1,818) (1,501)

Tax (138) (245)

Net assets 2,931 2,707

US$ US$

Net assets per share 2.96 2.74

Accounting policies, estimates

and assumptions

The principal accounting policies used

are shown in note 5 to the Group financial

statements. Details of critical accounting

estimates and assumptions are shown

in note 6(a) to those financial statements.

The most significant of these relate to tax,

pension benefits, goodwill and financial

instruments and the key features can be

summarised as follows:

•Estimates made in respect of tax assets

and liabilities include the consideration

of transactions in the ordinary course

of business for which the ultimate tax

determination is uncertain.

•The recognition of pension benefits

involves the selection of appropriate

actuarial assumptions. Changes to these

may impact on the amounts disclosed in

the Group financial statements.

•The assumptions used in the cash flow

projections underpinning the impairment

testing of goodwill include assumptions

in respect of profitability and future

growth, together with pre-tax discount

rates specific to the Group’s operating

segments.

•The contractual arrangements in respect

of the put option associated with the

remaining 30% stake of Serasa.