Experian 2012 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

119

Governance Financial statementsBusiness reviewBusiness overview

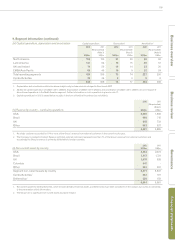

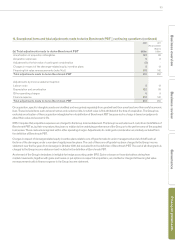

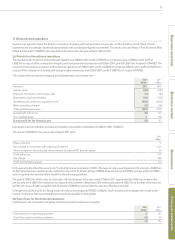

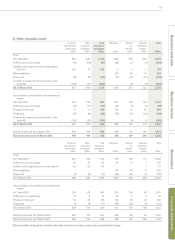

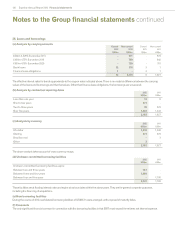

18. Earnings per share (continued)

Reconciliation of Overall benchmark earnings to profit for the financial year

2012

US$m

20 11

(Re-presented)

(Note 3)

US$m

Overall benchmark earnings (non-GAAP measure) 854 722

(Loss)/profit from discontinued operations (6) 85

Loss from exceptional items and total adjustments made to derive Benchmark PBT (130) (184)

Profit for the financial year 718 623

Weighted average number of ordinary shares

2012

million

2011

million

Weighted average number of ordinary shares 989 1,002

Dilutive effect of share incentive awards 17 22

Diluted weighted average number of ordinary shares 1,006 1,024

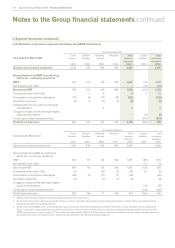

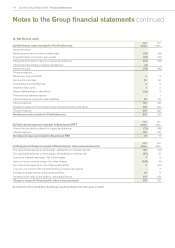

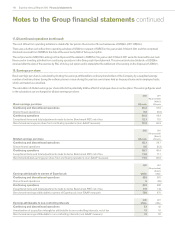

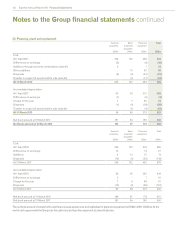

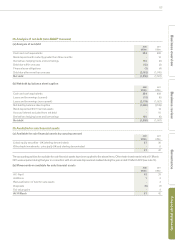

19. Dividends

2012 2011

US cents

per share US$m

US cents

per share US$m

Amounts recognised and paid during the financial year:

First interim - paid in January 2012 (2011: January 2011) 10.25 102 9.00 90

Second interim - paid in July 2011 (2011: July 2010) 19.00 188 16.00 161

Ordinary dividends paid on equity shares 29.25 290 25.00 251

Full year dividend for the financial year 32.00 317 28.00 278

A dividend of 21.75 US cents per ordinary share will be paid on 20 July 2012 to shareholders on the register at the close of business on 22 June

2012 and is not included as a liability in these financial statements. This dividend, together with the first interim dividend of 10.25 US cents per

ordinary share paid in January 2012, comprises the full year dividend for the financial year of 32.00 US cents.

Unless shareholders elect by 22 June 2012 to receive US dollars, their dividends will be paid in sterling at a rate per share calculated on the basis

of the exchange rate from US dollars to sterling on 29 June 2012.

Pursuant to the Income Access Share arrangements put in place in October 2006, shareholders in the Company can elect to receive their

dividends from a UK source (the ‘IAS election’). Shareholders who held 50,000 or fewer Experian shares (i) on the date of admission of the

Company’s shares to listing on the London Stock Exchange or (ii) in the case of shareholders who did not own shares at that time, on the first

dividend record date after they became shareholders in the Company, will be deemed to have elected to receive their dividends under the IAS

election arrangements unless they elect otherwise. Shareholders who hold more than 50,000 shares and who wish to receive their dividends

from a UK source must make an IAS election. All elections remain in force indefinitely unless revoked. Unless shareholders have made, or are

deemed to have made, an IAS election, dividends will be received from an Irish source and will be taxed accordingly.

In the year ended 31 March 2012 the employee trusts waived their entitlements to dividends of US$4m (2011: US$3m). There is no entitlement to

dividend in respect of own shares held in treasury.