Experian 2012 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

GovernanceBusiness reviewBusiness overview Financial statements

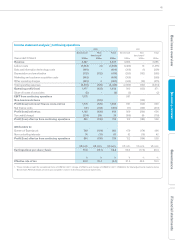

Income statement analysis – continuing operations

2012 2011

Year ended 31 March

Benchmark

US$m

Non-

benchmark1

US$m

Total

US$m

Benchmark

US$m

Non-

benchmark1

US$m

Total

US$m

Revenue 4,487 -4,487 3,885 -3,885

Labour costs (1,694) (5) (1,699) (1,486) 10 (1,476)

Data and information technology costs (400) -(400) (308) (1) (309)

Depreciation and amortisation (312) (122) (434) (283) (102) (385)

Marketing and customer acquisition costs (405) -(405) (369) -(369)

Other operating charges (499) 2(497) (446) (29) (475)

Total operating expenses (3,310) (125) (3,435) (2,892) (122) (3,014)

Operating profit/(loss) 1,177 (125) 1,052 993 (122) 871

Share of losses of associates (2) -(2) (2) -(2)

EBIT from continuing operations 1,175 991

Non-benchmark items (125) (122)

Profit/(loss) before net finance costs and tax 1,175 (125) 1,050 991 (122) 869

Net finance costs (47) (314) (361) (71) (142) (213)

Profit/(loss) before tax 1,128 (439) 689 920 (264) 656

Tax credit/(charge) (274) 309 35 (198) 80 (118)

Profit/(loss) after tax from continuing operations 854 (130) 724 722 (184) 538

Attributable to:

Owners of Experian plc 780 (119) 661 670 (174) 496

Non-controlling interests 74 (11) 63 52 (10) 42

Profit/(loss) after tax from continuing operations 854 (130) 724 722 (184) 538

US cents US cents US cents US cents US cents US cents

Earnings/(loss) per share – basic 78.9 (12.1) 66.8 66.9 (17.5) 49.4

%%%%%%

Effective rate of tax 24.3 70.4 (5.1) 21.5 30.3 18.0

1. These include a credit for exceptional items of US$12m (2011: charge of US$2m) and charges of US$451m (2011: US$262m) for total adjustments made to derive

Benchmark PBT, full details of which are included in note 13 to the Group financial statements.