Experian 2012 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

129

Governance Financial statementsBusiness reviewBusiness overview

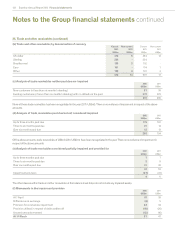

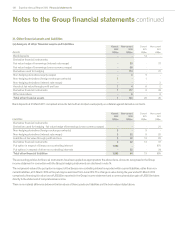

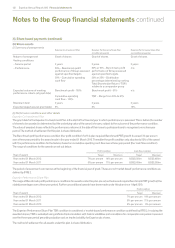

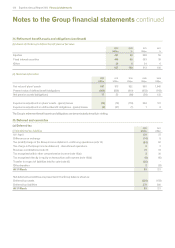

31. Other financial assets and liabilities (continued)

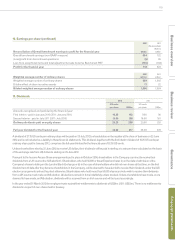

(b) Fair value and notional principal amounts of derivative financial instruments

2012 2011

Assets Liabilities Assets Liabilities

Fair value

US$m

Notional

US$m

Fair value

US$m

Notional

US$m

Fair value

US$m

Notional

US$m

Fair value

US$m

Notional

US$m

Cross currency swaps 80 1,347 - - - - 31 1,347

Interest rate swaps 33 759 35 1,315 39 646 28 864

Equity swaps 4 21 - - 5 14 - 10

Foreign exchange contracts 7 497 3 256 1 272 5 407

124 2,624 38 1,571 45 932 64 2,628

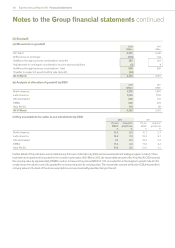

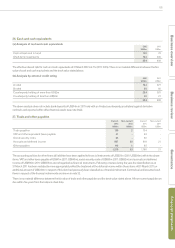

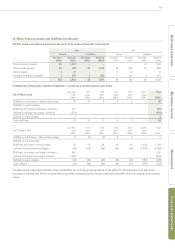

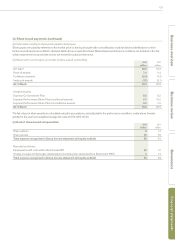

(c) Maturity of derivative financial liabilities - contractual undiscounted cash flows

At 31 March 2012

Less than

1 year

US$m

1 to 2

years

US$m

2 to 3

years

US$m

3 to 4

years

US$m

4 to 5

years

US$m

Over 5

years

US$m

Total

US$m

Settled on a net basis - interest rate swaps 16 12 9 6 2 1 46

Settled on a gross basis:

Outflows for foreign exchange contracts 281 -----281

Inflows for foreign exchange contracts (279) - - - - - (279)

Settled on a gross basis 2 - - - - - 2

Cash outflows 18 12 9 6 2 1 48

At 31 March 2011

Less than

1 year

US$m

1 to 2

years

US$m

2 to 3

years

US$m

3 to 4

years

US$m

4 to 5

years

US$m

Over 5

years

US$m

Total

US$m

Settled on a net basis - interest rate swaps 6 (4) (9) 6 3 - 2

Settled on a gross basis:

Outflows for cross currency swaps 25 24 24 24 24 1,428 1,549

Inflows for cross currency swaps (58) (64) (64) (64) (64) (1,578) (1,892)

Outflows for foreign exchange contracts 682 - - - - - 682

Inflows for foreign exchange contracts (679) - - - - - (679)

Settled on a gross basis (30) (40) (40) (40) (40) (150) (340)

Cash inflows (24) (44) (49) (34) (37) (150) (338)

The table above analyses the derivative financial liabilities into maturity groupings based on the period from the balance sheet date to the

contractual maturity date. As the amounts disclosed are the contractual undiscounted cash flows, they differ from the carrying values and fair

values.