Experian 2012 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

113

Governance Financial statementsBusiness reviewBusiness overview

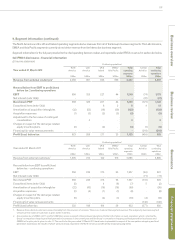

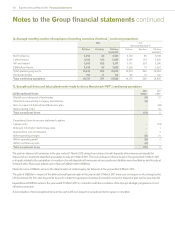

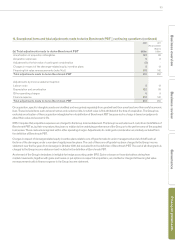

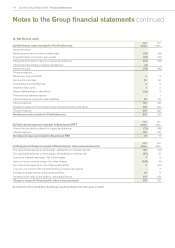

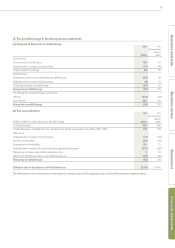

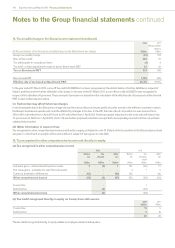

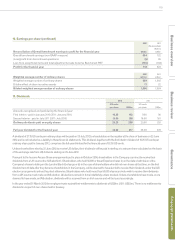

13. Exceptional items and total adjustments made to derive Benchmark PBT – continuing operations (continued)

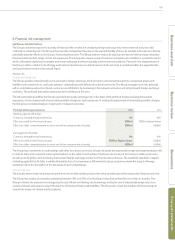

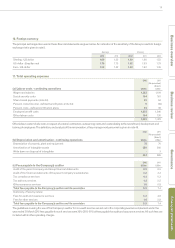

(b) Total adjustments made to derive Benchmark PBT

2012

US$m

20 11

(Re-presented)

(Note 3)

US$m

Amortisation of acquisition intangibles 122 99

Acquisition expenses 9 8

Adjustment to the fair value of contingent consideration (3) -

Charges in respect of the demerger-related equity incentive plans 5 13

Financing fair value remeasurements (note 14(c)) 318 142

Total adjustments made to derive Benchmark PBT 451 262

Adjustments by income statement caption:

Labour costs 5 13

Depreciation and amortisation 122 99

Other operating charges 6 8

Finance expense 318 142

Total adjustments made to derive Benchmark PBT 451 262

On acquisition, specific intangible assets are identified and recognised separately from goodwill and then amortised over their useful economic

lives. These include items such as brand names and customer lists, to which value is first attributed at the time of acquisition. The Group has

excluded amortisation of these acquisition intangibles from its definition of Benchmark PBT because such a charge is based on judgments

about their value and economic life.

IFRS 3 requires that acquisition expenses are charged to the Group income statement. The Group has excluded such costs from its definition of

Benchmark PBT as, by their very nature, they bear no relation to the underlying performance of the Group or to the performance of the acquired

businesses. These costs are recognised within other operating charges. Adjustments to contingent consideration are similarly excluded from

the definition of Benchmark PBT.

Charges in respect of demerger-related equity incentive plans relate to one-off grants made to senior management and at all staff levels at

the time of the demerger, under a number of equity incentive plans. The cost of these one-off grants has been charged to the Group income

statement over the five years from demerger in October 2006, but excluded from the definition of Benchmark PBT. The cost of all other grants is

charged to the Group income statement and included in the definition of Benchmark PBT.

An element of the Group’s derivatives is ineligible for hedge accounting under IFRS. Gains or losses on these derivatives arising from

market movements, together with gains and losses on put options in respect of acquisitions, are credited or charged to financing fair value

remeasurements within finance expense in the Group income statement.