Experian 2012 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

153

Governance Financial statementsBusiness reviewBusiness overview

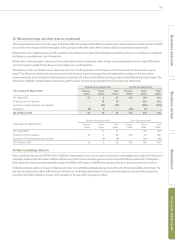

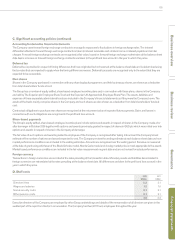

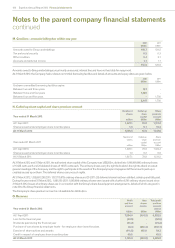

C. Significant accounting policies (continued)

Accounting for derivative financial instruments

The Company uses forward foreign exchange contracts to manage its exposures to fluctuations in foreign exchange rates. The interest

differential reflected in forward foreign exchange contracts is taken to interest receivable and similar income or interest payable and similar

charges. Forward foreign exchange contracts are recognised at fair value, based on forward foreign exchange market rates at the balance sheet

date. Gains or losses on forward foreign exchange contracts are taken to the profit and loss account in the year in which they arise.

Deferred tax

Deferred tax is provided in respect of timing differences that have originated but not reversed at the balance sheet date and is determined using

the tax rates that are expected to apply when the timing differences reverse. Deferred tax assets are recognised only to the extent that they are

expected to be recoverable.

Own shares

Shares in the Company purchased in connection with any share buyback programme, and held as treasury shares, are shown as a deduction

from total shareholders’ funds at cost.

The Group has a number of equity settled, share-based employee incentive plans and, in connection with these plans, shares in the Company

are held by The Experian plc Employee Share Trust and the Experian UK Approved All-Employee Share Plan. The assets, liabilities and

expenses of these separately administered trusts are included in the Company’s financial statements as if they were the Company’s own. The

assets of the trusts mainly comprise shares in the Company and such shares are also shown as a deduction from total shareholders’ funds at

cost.

Contractual obligations to purchase own shares are recognised at the net present value of expected future payments. Gains and losses in

connection with such obligations are recognised in the profit and loss account.

Share-based payments

The Group’s equity settled, share-based employee incentive plans include options and awards in respect of shares in the Company made at or

after demerger in October 2006 together with options and awards previously granted in respect of shares in GUS plc which were rolled over into

options and awards in respect of shares in the Company at demerger.

The fair value of such options and awards granted to employees of the Company is recognised after taking into account the Company’s best

estimate of the number of options and awards expected to vest. The Company revises the vesting estimate at each balance sheet date and non-

market performance conditions are included in the vesting estimates. Amounts are recognised over the vesting period. Fair value is measured

at the date of grant using whichever of the Black-Scholes model, Monte Carlo model and closing market price is most appropriate to the award.

Market based performance conditions are included in the fair value measurement on grant date and are not revised for actual performance.

Foreign currency

Transactions in foreign currencies are recorded at the rates prevailing at the transaction date. Monetary assets and liabilities denominated in

foreign currencies are retranslated at the rates prevailing at the balance sheet date. All differences are taken to the profit and loss account in the

year in which they arise.

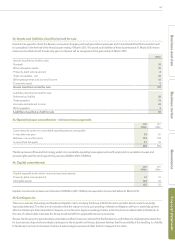

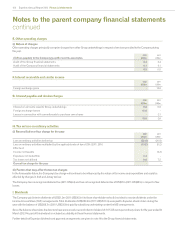

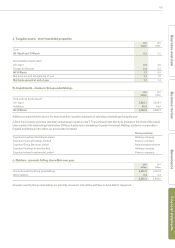

D. Staff costs

2012

US$m

2011

US$m

Directors’ fees 2.2 2.1

Wages and salaries 1.2 1.0

Social security costs 0.1 0.1

Other pension costs 0.1 0.1

3.6 3.3

Executive directors of the Company are employed by other Group undertakings and details of the remuneration of all directors are given in the

audited part of the report on directors’ remuneration. The Company had two (2011: two) employees throughout the year.