Experian 2012 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

143

Governance Financial statementsBusiness reviewBusiness overview

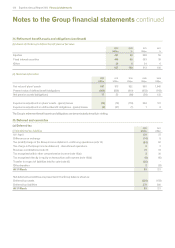

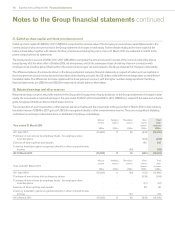

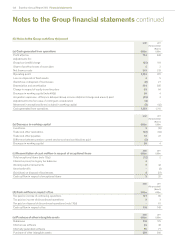

38. Retained earnings and other reserves (continued)

The merger reserve arose on the demerger in October 2006 and represents the difference between the share capital and share premium of GUS

plc and the nominal value of the share capital of the Company before the share offer in October 2006 and subsequent share issues.

Movements on the hedging reserve and the position at the balance sheet date reflect hedging transactions which are not charged or credited to

the Group income statement, net of related tax.

Movements on the translation reserve and the position at the balance sheet date reflect foreign currency translations since 1 April 2004 which

are not charged or credited to the Group income statement, net of related tax.

The balance on the own shares reserve represents the cost of ordinary shares in the Company and further details of movements are given

below. The difference between the amounts shown in the Group and parent company financial statements in respect of the own shares

reserve arose due to the translation of the sterling amounts into US dollars at the different exchange rates on the different translation dates. The

difference is US$32m at both balance sheet dates, with the larger number being reported in the Group financial statements.

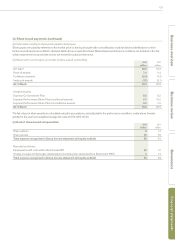

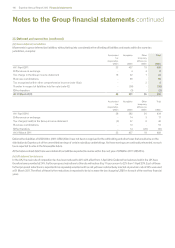

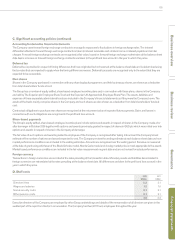

Number of own shares held Cost of own shares held

Year ended 31 March 2012 Tr e asur y

million

Trus t s

million

Total

million

Treasury

US$m

Trus t s

US$m

Total

US$m

At 1 April 2011 30 8 38 334 100 434

Purchase of own shares - 18 18 - 224 224

Exercise of share options and awards - (16) (16) - (166) (166)

Transfers (6) 6 - (60) 60 -

At 31 March 2012 24 16 40 274 218 492

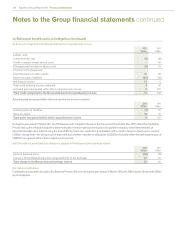

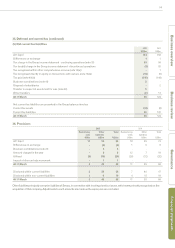

Number of own shares held Cost of own shares held

Year ended 31 March 2011 Treasury

million

Trusts

million

Total

million

Treasury

US$m

Trusts

US$m

Total

US$m

At 1 April 2010 - 11 11 - 125 125

Purchase of own shares 30 6 36 334 61 395

Exercise of share options and awards - (9) (9) - (86) (86)

At 31 March 2011 30 8 38 334 100 434

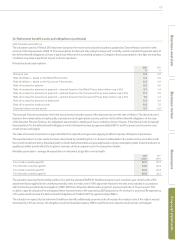

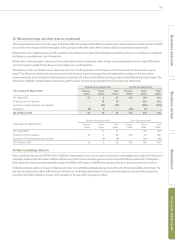

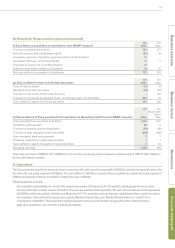

39. Non-controlling interests

Non-controlling interests of US$159m (2011: US$161m) represents the share of net assets of subsidiary undertakings held outside the Group and

principally relates to the 30% stake in Serasa. Movements in the current and prior year are summarised in the Group statement of changes in

total equity and include currency translation losses of US$16m (2011: gains of US$18m) recognised directly in other comprehensive income.

Obligations for put options in respect of Serasa and other non-controlling interests are reported within other financial liabilities (note 31(a)). The

put and call options associated with the shares held by non-controlling shareholders in Serasa are exercisable for a period of five years from

June 2012 and further details in respect of the valuation of the put option are given in note 8.