Experian 2012 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99

Governance Financial statementsBusiness reviewBusiness overview

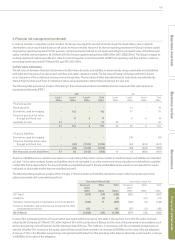

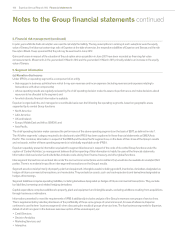

5. Significant accounting policies (continued)

(n) Contingent consideration

The cost of each acquisition initially recorded includes a reasonable estimate of the fair value of any contingent amounts expected to be payable

in the future. In accordance with IFRS 3, any cost or benefit arising when revised estimates of such consideration are made is recognised in the

Group income statement.

(o) Current and deferred tax

The tax charge or credit for the year for current and deferred tax is recognised in the Group income statement, except to the extent that it relates

to items recognised in other comprehensive income or directly in equity. In such cases the tax is recognised in other comprehensive income or

directly in equity as appropriate.

Current income tax is calculated on the basis of the tax laws enacted or substantively enacted at the balance sheet date in the countries where

the Group operates.

Deferred tax is provided in full on temporary differences arising between the tax bases of assets and liabilities and their carrying amounts in

the Group financial statements. Deferred tax is not recognised on taxable temporary differences arising on the initial recognition of goodwill.

Deferred tax that arises from the initial recognition of an asset or liability in a transaction, other than a business combination, that at the time of

the transaction affects neither accounting nor taxable profit or loss, is not accounted for. Deferred tax assets and liabilities are calculated at the

tax rates that are expected to apply to the period when the asset is realised or the liability is settled, based on the tax rates and laws that have

been enacted or substantively enacted by the balance sheet date.

Deferred tax assets are recognised to the extent that it is probable that future taxable profit will be available against which the temporary

differences can be utilised.

Deferred tax is provided on temporary differences arising on investments in subsidiaries and associates, except where the timing of the reversal

of the temporary difference is controlled by the Group and it is probable that the temporary difference will not reverse in the foreseeable future.

(p) Provisions

Where the effect of the time value of money is material, provisions are determined by discounting the expected future cash flows at a pre-

tax rate that reflects current market assessments of the time value of money and, where appropriate, the risks specific to the liability. Where

discounting is used, the increase in the provision due to the passage of time is recognised as an interest expense.

(q) Assets and liabilities classified as held for sale

Assets and liabilities are classified as held for sale when their carrying amounts are to be recovered or settled principally through a sale

transaction and a sale is considered highly probable. They are stated at the lower of the carrying amount and fair value less costs to sell.

(r) Own shares

Shares in the Company purchased in connection with any share buyback programme, and held as treasury shares, are shown as a deduction

from total equity at cost.

The Group has a number of equity settled, share-based employee incentive plans and, in connection with these plans, own shares are held

by The Experian plc Employee Share Trust and the Experian UK Approved All-Employee Share Plan. The assets of the trusts mainly comprise

shares in the Company and such shares are also shown as a deduction from total equity at cost.

Contractual obligations to purchase own shares are recognised at the net present value of expected future payments. Gains and losses in

connection with such obligations are recognised in the Group income statement.

(s) Revenue recognition

Revenue represents the fair value of consideration receivable on the sale of goods and services to clients, net of value added tax and other

sales taxes, rebates and discounts. Revenue includes the provision and processing of data, subscriptions to services, software and database

customisation and development and the sale of software licences, maintenance and related consulting services.

Revenue in respect of the provision and processing of data is recognised in the year in which the service is provided. Subscription revenues, and

revenues in respect of services to be provided by an indeterminate number of acts over a specified period of time, are recognised on a straight

line basis over those periods. Customisation, development and consulting revenues are recognised by reference to the stage of completion of

the work generally on the basis of costs incurred to date as a percentage of estimated total costs. Revenue from software licences is recognised

upon delivery. Revenue from maintenance agreements is recognised on a straight line basis over the term of the maintenance period.