Experian 2012 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

141

Governance Financial statementsBusiness reviewBusiness overview

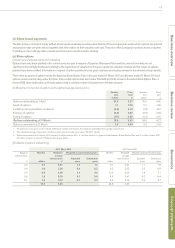

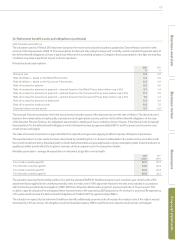

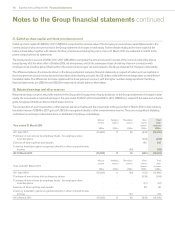

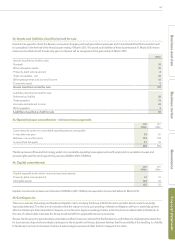

35. Deferred and current tax (continued)

(b) Net current tax liabilities

2012

US$m

2011

US$m

At 1 April 124 150

Differences on exchange 1 1

Tax charge in the Group income statement - continuing operations (note 15) 49 56

Tax (credit)/charge in the Group income statement - discontinued operations (5) 55

Tax recognised within other comprehensive income (note 16(a)) - 1

Tax recognised directly in equity on transactions with owners (note 16(b)) (15) (5)

Tax paid (note 40(d)) (116) (149)

Business combinations (note 41) 5-

Disposal of subsidiaries - 2

Transfer in respect of assets held for sale (note 42) 5 -

Other transfers (2) 13

At 31 March 46 124

Net current tax liabilities are presented in the Group balance sheet as:

Current tax assets (10) (8)

Current tax liabilities 56 132

At 31 March 46 124

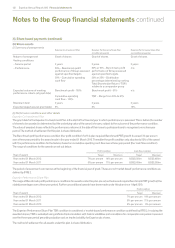

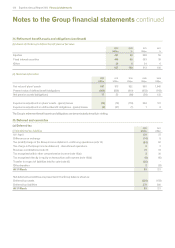

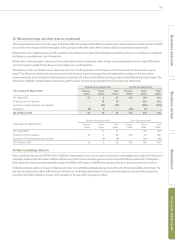

36. Provisions

2012 2011

Restructuring

costs

US$m

Other

liabilities

US$m

Total

US$m

Restructuring

costs

US$m

Other

liabilities

US$m

Total

US$m

At 1 April 11 55 66 18 55 73

Differences on exchange -(6) (6) 1 5 6

Business combinations (note 41) - 3 3 - - -

Amount charged in the year - 8 8 12 7 19

Utilised (8) (16) (24) (20) (12) (32)

Impact of discount rate movement - 1 1 - - -

At 31 March 3 45 48 11 55 66

Disclosed within current liabilities 2 36 38 7 40 47

Disclosed within non-current liabilities 1 9 10 4 15 19

At 31 March 3 45 48 11 55 66

Other liabilities principally comprise liabilities of Serasa, in connection with local legal and tax issues, which were primarily recognised on the

acquisition of that company. Adjustments to such amounts are made as the exposures are concluded.