Experian 2012 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

144 Experian Annual Report 2012 Financial statements

Notes to the Group financial statements continued

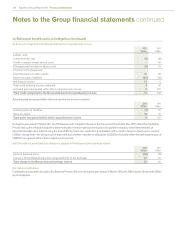

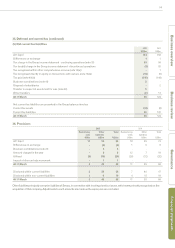

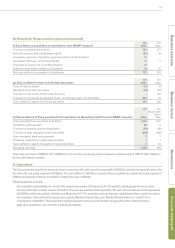

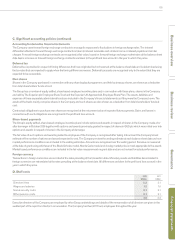

40. Notes to the Group cash flow statement

(a) Cash generated from operations

2012

US$m

20 11

(Re-presented)

(Note 3)

US$m

Profit after tax 724 538

Adjustments for:

Group tax (credit)/charge (35) 118

Share of post-tax losses of associates 2 2

Net finance costs 361 213

Operating profit 1,052 871

Loss on disposals of fixed assets 45

(Gain)/loss on disposal of businesses (8) 21

Depreciation and amortisation 434 385

Charge in respect of equity incentive plans 65 64

Decrease in working capital (note 40(b)) 20 4

Acquisition expenses - difference between Group income statement charge and amount paid (20) 3

Adjustment to the fair value of contingent consideration (3) -

Movement in exceptional items included in working capital (5) (42)

Cash generated from operations 1,539 1,311

(b) Decrease in working capital

2012

US$m

20 11

(Re-presented)

(Note 3)

US$m

Inventories 3(10)

Trade and other receivables (38) (33)

Trade and other payables 57 47

Difference between pension current service cost and contributions paid (2) -

Decrease in working capital 20 4

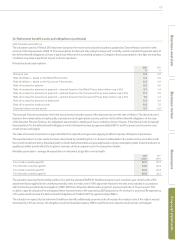

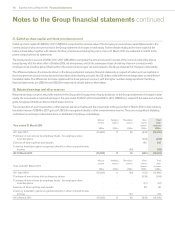

(c) Reconciliation of cash outflow in respect of exceptional items

2012

US$m

2011

US$m

Total exceptional items (note 13(a)) (12) 2

Interest received on legacy tax balances 4-

Working capital movements 5 42

Asset write-offs - (3)

Gain/(loss) on disposal of businesses 8 (21)

Cash outflow in respect of exceptional items 5 20

(d) Cash outflow in respect of tax

2012

US$m

20 11

(Re-presented)

(Note 3)

US$m

Tax paid on income of continuing operations 107 85

Tax paid on income of discontinued operations 93

Tax paid on disposal of discontinued operations (note 17(b)) -61

Cash outflow in respect of tax 116 149

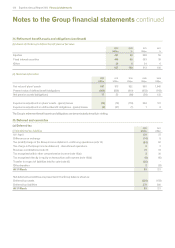

(e) Purchase of other intangible assets

2012

US$m

20 11

US$m

Databases 218 175

Internal use software 55 48

Internally generated software 96 77

Purchase of other intangible assets 369 300