Experian 2012 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

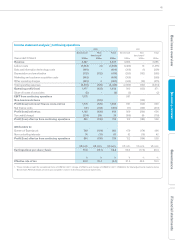

GovernanceBusiness reviewBusiness overview Financial statements

EBIT and margin

For EMEA/Asia Pacific, EBIT from

continuing activities was US$44m, down

16% at constant exchange rates. EBIT

margin was 7.2% (2011: 10.4%). The decline

in EBIT was due to increased investment in

the Australian bureau development, negative

operating leverage in Decision Analytics and

a one-off charge in relation to investment in a

new sales structure in EMEA.

Social, ethical and

environmental performance

EMEA/Asia Pacific made the most

dramatic improvements in the Group, with

a rise in community volunteering especially

in EMEA, and a large rise in regional giving

in Asia Pacific. India established a strong

programme of financial education and is

developing video, online and paper based

education materials to reach people in all

sectors of society.

The combined carbon footprint increased

slightly but we made a 9% reduction in our

use of energy in EMEA. The number of

offices across the whole region reporting

actual data increased significantly, going

up to just over 80%, reducing our reliance

on estimates and indicating that more

people are aware of the relevance of

reporting this information.

Chris Clark

Managing Director,

EMEA

“We made good progress this year

in the emerging markets of Eastern

Europe, in new segments such as

telecommunications and in the sale

of digital marketing products. All of

this helped offset the challenging

economic conditions in our

Western European markets. We’re

continuing to invest in our services

and infrastructure to ensure we can

support our clients’ strategies for

enhanced growth and cost reduction.”

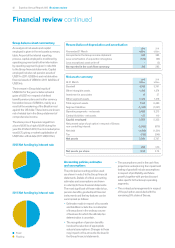

08 09 10 11 12

08 09 10 11 12

08 09 10 11 12

Organic revenue growth EBIT (US$m) and margin

Total revenue growth 2012 revenue by activity1

EBIT excludes discontinuing activities.

EBIT margin is for continuing activities only.

7%

6%

1%

7% 7% 12.3%

87

11.5%

49

11.2%

51

10.4%

52 7.2%

44

13%

19%

6%

12%

17%

¹Excludes discontinuing activities.

Credit

Services 35%

Decision

Analytics 21%

Marketing

Services 44%