Experian 2012 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

105

Governance Financial statementsBusiness reviewBusiness overview

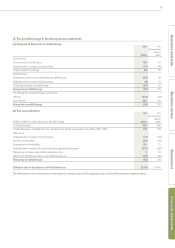

8. Financial risk management (continued)

In order to maintain or adjust the capital structure, the Group may adjust the amount of dividends paid to shareholders, return capital to

shareholders, issue or purchase shares or sell assets to reduce net debt. As part of its internal reporting processes the Group monitors capital

employed by operating segment. For this purpose, capital employed is defined as net assets excluding the net present value of the Serasa put

option, net debt, and tax balances. At 31 March 2012 the Group’s capital employed was US$5,979m (2011: US$5,323m). The Group manages its

working capital and capital expenditure in order to meet its target to convert at least 90% of EBIT into operating cash flow and the conversion

percentage for the year ended 31 March 2012 was 96% (2011: 98%).

(c) Fair value estimation

The fair value of derivative financial instruments and other financial assets and liabilities is determined by using market data and established

estimation techniques such as discounted cash flow and option valuation models. The fair value of foreign exchange contracts is based

on a comparison of the contractual and year end exchange rates. The fair values of other derivative financial instruments are estimated by

discounting the future cash flows to net present values using appropriate market rates prevailing at the year end.

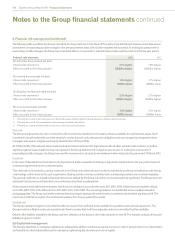

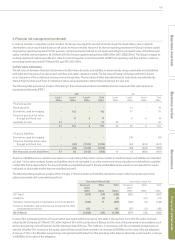

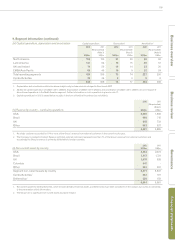

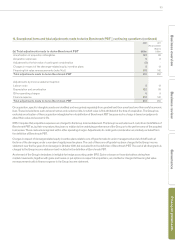

The following table presents an analysis of the Group’s financial assets and financial liabilities that are measured at fair value by level, as

required and defined by IFRS 7:

2012 2011

Level 1

US$m

Level 2

US$m

Level 3

US$m

Total

US$m

Level 1

US$m

Level 2

US$m

Level 3

US$m

Total

US$m

Financial assets:

Bank deposits - - - - -14 -14

Derivatives used for hedging -113 -113 -37 -37

Financial assets at fair value

through profit and loss -11 617 - 8 6 14

Available for sale 37 - - 37 42 - - 42

37 124 6167 42 59 6107

Financial liabilities:

Derivatives used for hedging - - - - -(31) -(31)

Financial liabilities at fair value

through profit and loss -(38) (1,124) (1,162) -(33) (904) (937)

-(38) (1,124) (1,162) -(64) (904) (968)

Net financial assets/(liabilities) 37 86 (1,118) (995) 42 (5) (898) (861)

Assets and liabilities whose valuations are based on unadjusted quoted prices in active markets for identical assets and liabilities are classified

as Level 1 in the above analysis. Assets and liabilities which are not traded in an active market and whose valuations are derived from available

market data that is observable for the asset or liability are classified as Level 2. Assets and liabilities whose valuations are derived from inputs

not based on observable market data are classified as Level 3.

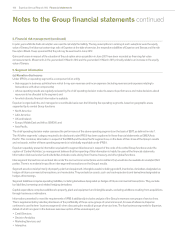

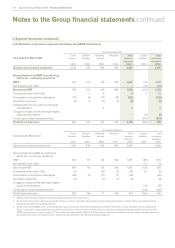

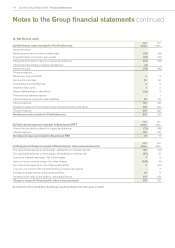

The following table presents an analysis of the changes in financial assets and liabilities classified as Level 3 which comprise put and call

options associated with corporate transactions:

Year ended 31 March 2012 Year ended 31 March 2011

Serasa put

option

US$m

Other

US$m

Total

US$m

Serasa put

option

US$m

Other

US$m

Total

US$m

At 1 April (870) (28) (898) (661) 1(660)

Additions -(9) (9) -(21) (21)

Valuation (losses)/gains recognised in income statement (325) 11 (314) (142) (6) (148)

Currency translation gains and losses recognised in other

comprehensive income 103 -103 (67) (2) (69)

At 31 March (1,092) (26) (1,118) (870) (28) (898)

In view of the anticipated exercise of the put option associated with the remaining 30% stake in Serasa from June 2012, the option has been

valued by the Company at 31 March 2012 at the higher of 95% of the equity value of Serasa and the value of Serasa based on assumptions such

as the price/earnings ratio of Experian and the latest earnings of Serasa. This method is in accordance with the contractual arrangements on

exercise. A further 10% increase in the equity value of Serasa would have resulted in an increase of US$109m in the value of the put obligation.

A change of 10% in the Brazilian real exchange rate against the US dollar from that prevailing at the balance sheet date would result in a change

of US$109m in the value of the obligation.