Experian 2012 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72 Experian Annual Report 2012 Governance

Report on directors’ remuneration continued

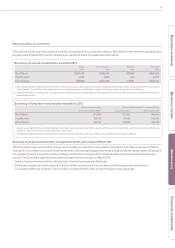

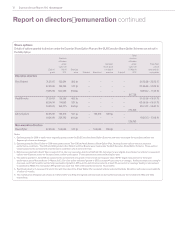

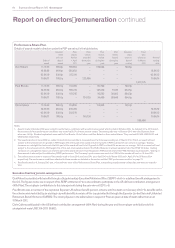

The operation of the CIP is described in the following schematic:

Performance conditions are determined by the Committee in advance of grant and dividend equivalents accrue on these awards. If a participant

resigns during the three-year period they forfeit the right to the matching shares and the associated dividends, although they would be entitled

to retain any invested shares. Matching awards under the CIP may vest early in the event of a change of control but will be pro-rated for time

and performance.

Details of the awards granted in June 2011 are given in the table entitled ‘GUS and Experian Co-investment Plans and Experian Reinvestment

Plans’.

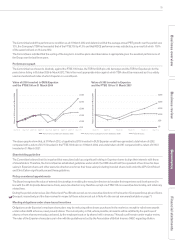

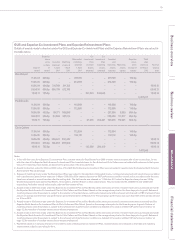

CIP performance metrics

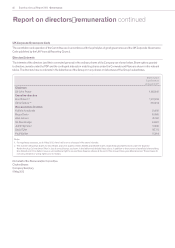

From 2010 the vesting of awards under the CIP has been based 50% on the achievement of a growth in PBT performance condition,

measured over three years, with the other 50% subject to the achievement of a three-year cash flow target. The Committee selected these

two performance measures as they reflect two of Experian’s key strategic objectives (driving profitable growth and optimising capital

efficiency).

The executive directors have elected to defer 100% of their bonus earned in respect of the year ended 31 March 2012 into the CIP. It is intended

that the same performance measures will be used for the matching awards to be made in May 2012 as for the awards made in June 2011 (i.e.

growth in PBT and cash flow). Economic conditions continue to be challenging and as a result the Committee believes that the PBT growth

target set in 2011 continues to be appropriately calibrated. The cash flow target has been increased to reflect the Group’s increasing absolute

profitability. Both performance conditions will be measured over a three-year period and the specific targets for the May 2012 awards are set out

in the following tables along with the targets for the 2010 and 2011 awards:

* straight line vesting between points

In addition, vesting of any awards made in June 2011 and May 2012 will be subject to the Committee being satisfied that the vesting is not based

on financial results which have been materially misstated.

Invested shares Invested shares

released in full

Annual bonus, where

earned, is deferred

and invested in

Experian shares

Matching shares

(Up to 2 : 1 match

on Invested shares).

Committee sets

performance targets

Matching shares

released to the extent

that performance

conditions are

satised

Three year

deferral period

Three year

performance

period

PBT growth (50% of an award)

Vesting*

0% 50% 100%

2010 Below 5% 5% 11%

2011 Below 7% 7% 14%

2012 Below 7% 7% 14%

Cash flow (50% of an award)

Vesting*

0% 50% 100%

2010 Below $2.9bn $2.9bn $3.3bn

2011 Below $3.0bn $3.0bn $3.4bn

2012 Below $3.7bn $3.7bn $4.1bn

P79