Experian 2012 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

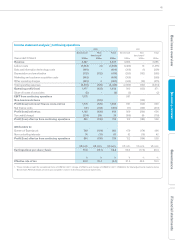

GovernanceBusiness reviewBusiness overview Financial statements

Financial risk management

The risks and uncertainties that are specific

to our business together with more general

risks are set out in the risks and uncertainties

section of this report. Our financial risk

management focuses on the unpredictability

of financial markets and seeks to minimise

potentially adverse effects on our financial

performance.

We seek to reduce exposures to foreign

exchange, interest rate and other financial

risks. Detailed disclosures in respect of such

risks are included in the notes to the Group

financial statements and the key features are

summarised below.

Foreign exchange risk is managed by:

•Entering into forward foreign exchange

contracts in the relevant currencies in

respect of investments in entities with

functional currencies other than US

dollars, whose net assets are exposed to

foreign exchange translation risk;

•Swapping the proceeds of certain bonds

issued in sterling and euros into US

dollars;

•Denominating internal loans in relevant

currencies to match the currencies of

assets and liabilities in entities with

different functional currencies; and

•Use of forward foreign exchange contracts

for certain future commercial transactions.

Interest rate risk is managed by:

•Use of both fixed and floating rate

borrowings;

•Use of interest rate swaps to adjust the

balance of fixed and floating rate liabilities;

and

•Mix of duration of borrowings and interest

rate swaps to smooth the impact of

interest rate fluctuations.

Credit risk is managed by:

•Dealing only with banks and financial

institutions with strong credit ratings,

within limits set for each organisation; and

•Close control of dealing activity with

counterparty positions monitored

regularly.

Liquidity risk is managed by:

•Long-term committed facilities to ensure

that sufficient funds are available for

operations and planned expansion; and

•Monitoring of rolling forecasts of projected

cash flows to ensure that adequate

undrawn committed facilities are available.

2012 EBIT by currency

2011 EBIT by currency

US dollar

Brazilian real

Sterling

Other

2012 Borrowings by currency

2011 Borrowings by currency

US dollar

Sterling

Other

Borrowings by currency are stated after the effect

of forward foreign exchange contracts and cross

currency swaps.