Experian 2012 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

126 Experian Annual Report 2012 Financial statements

Notes to the Group financial statements continued

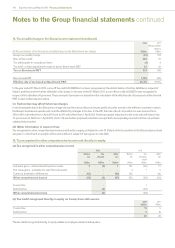

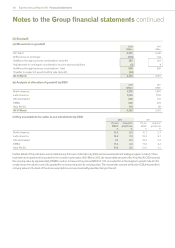

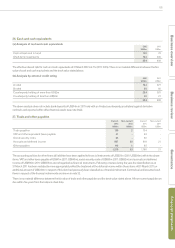

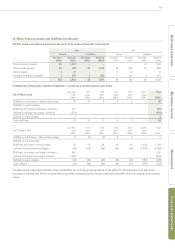

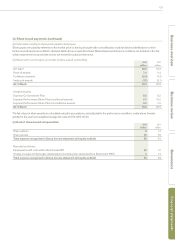

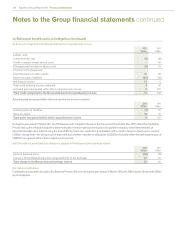

28. Loans and borrowings

(a) Analysis by carrying amounts

Current

2012

US$m

Non-current

2012

US$m

Current

2011

US$m

Non-current

2011

US$m

£334m 5.625% Euronotes 2013 - 571 - 576

£400m 4.75% Euronotes 2018 - 709 - 642

€500m 4.75% Euronotes 2020 - 729 - 701

Bank loans 12 170 3 1

Finance lease obligations 1 - 3 1

13 2,179 6 1,921

The effective interest rates for bonds approximate to the coupon rates indicated above. There is no material difference between the carrying

values of the loans and borrowings and their fair values. Other than finance lease obligations, the borrowings are unsecured.

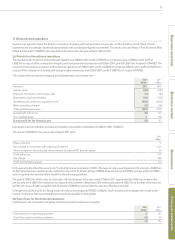

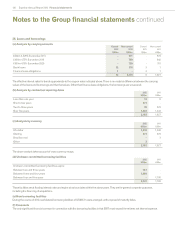

(b) Analysis by contractual repricing dates

2012

US$m

2011

US$m

Less than one year 13 8

One to two years 671 -

Two to three years 70 576

Over five years 1,438 1,343

2,192 1,927

(c) Analysis by currency

2012

US$m

2011

US$m

US dollar 1,618 1,348

Sterling 571 576

Brazilian real -3

Other 3 -

2,192 1,927

The above analysis takes account of cross currency swaps.

(d) Undrawn committed borrowing facilities

2012

US$m

2011

US$m

Undrawn committed borrowing facilities expire:

Between two and three years 167 -

Between three and four years 1,980 -

Between four and five years - 1,700

2,147 1,700

These facilities are at floating interest rates and expire at various dates within the above years. They are for general corporate purposes,

including the financing of acquisitions.

(e) New borrowing facilities

During the course of 2012 new bilateral borrowing facilities of US$617m were arranged, with a spread of maturity dates.

(f) Covenants

The only significant financial covenant in connection with the borrowing facilities is that EBIT must exceed three times net interest expense.