Experian 2012 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

107

Governance Financial statementsBusiness reviewBusiness overview

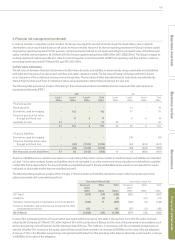

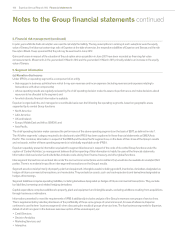

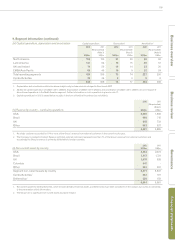

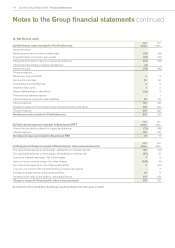

9. Segment information (continued)

The North America and the UK and Ireland operating segments derive revenues from all of the Group’s business segments. The Latin America,

EMEA and Asia Pacific segments currently do not derive revenue from the Interactive business segment.

Segment information for the full year provided to the chief operating decision maker, and reportable under IFRS 8, is set out in section (b) below.

(b) IFRS 8 disclosures - financial information

(i) Income statement

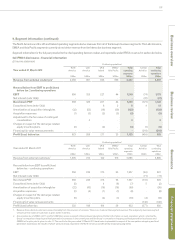

Continuing operations2

Year ended 31 March 2012

North

America

US$m

Latin

America

US$m

UK &

Ireland

US$m

EMEA/

Asia Pacific

US$m

Total

operating

segments

US$m

Central

Activities

US$m

Total

continuing

operations

US$m

Revenue from external customers12,092 961 825 609 4,487 - 4,487

Reconciliation from EBIT to profit/(loss)

before tax – continuing operations

EBIT 658 320 227 44 1,249 (74) 1,175

Net interest (note 14(b)) - - - - - (47) (47)

Benchmark PBT 658 320 227 44 1,249 (121) 1,128

Exceptional items (note 13(a)) - - 6 2 8 412

Amortisation of acquisition intangibles (32) (52) (18) (20) (122) -(122)

Acquisition expenses (1) (3) (2) (3) (9) -(9)

Adjustment to the fair value of contingent

consideration - 3 - - 3-3

Charges in respect of the demerger-related

equity incentive plans (2) -(2) -(4) (1) (5)

Financing fair value remeasurements - - - - - (318) (318)

Profit/(loss) before tax 623 268 211 23 1,125 (436) 689

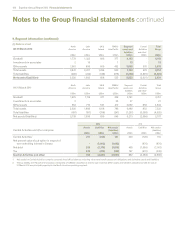

Continuing operations2

Year ended 31 March 2011

North

America

US$m

Latin

America

US$m

UK &

Ireland

US$m

EMEA/

Asia Pacific

US$m

Total

operating

segments

US$m

Central

Activities

US$m

Total

continuing

operations

US$m

Revenue from external customers11,905 722 742 516 3,885 - 3,885

Reconciliation from EBIT to profit/(loss)

before tax – continuing operations

EBIT 556 235 213 53 1,057 (66) 991

Net interest (note 14(b)) - - - - - (71) (71)

Benchmark PBT 556 235 213 53 1,057 (137) 920

Exceptional items (note 13(a)) (5) - 4 (6) (7) 5 (2)

Amortisation of acquisition intangibles (22) (43) (18) (16) (99) - (99)

Acquisition expenses (2) (4) (1) (1) (8) - (8)

Charges in respect of the demerger-related

equity incentive plans (5) - (4) (1) (10) (3) (13)

Financing fair value remeasurements - - - - - (142) (142)

Profit/(loss) before tax 522 188 194 29 933 (277) 656

1. Revenue from external customers arose principally from the provision of services. There is no material inter-segment revenue. The analysis by business segment

of revenue from external customers is given within note 9(c).

2. A loss before tax of US$9m (2011: profit of US$142m) arose in respect of discontinued operations. Further information on such operations which comprise the

Group’s comparison shopping and lead generation businesses in the current year and the Group’s comparison shopping and lead generation businesses and

FARES in the prior year is given in note 17. The results for the year ended 31 March 2011 have been re-presented in respect of the comparison shopping and lead

generation businesses, the results of which were previously reported in the North America and UK & Ireland operating segments.