Experian 2012 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164

|

|

138 Experian Annual Report 2012 Financial statements

Notes to the Group financial statements continued

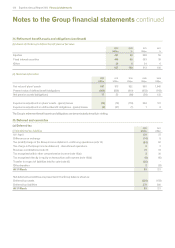

34. Retirement benefit assets and obligations (continued)

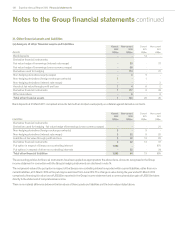

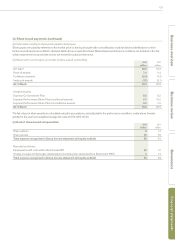

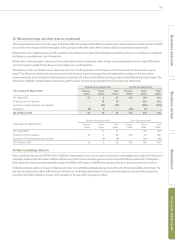

(ix) Assets of the Group’s defined benefit plans at fair value

2012

US$m

2012

%

2011

US$m

2011

%

Equities 457 48 506 55

Fixed interest securities 444 46 353 39

Other 56 654 6

957 100 913 100

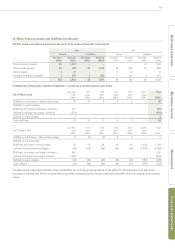

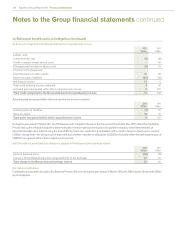

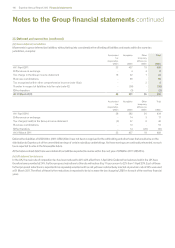

(x) Historical information

2012

US$m

2011

US$m

2010

US$m

2009

US$m

2008

US$m

Fair value of plans’ assets 957 913 822 595 1,045

Present value of defined benefit obligations (880) (858) (910) (653) (913)

Net pension assets/(obligations) 77 55 (88) (58) 132

Experience adjustment on plans’ assets - (gains)/losses (16) (10) (178) 236 101

Experience adjustment on defined benefit obligations - (gains)/losses (2) (57) (1) 1 8

The Group’s retirement benefit assets and obligations are denominated primarily in sterling.

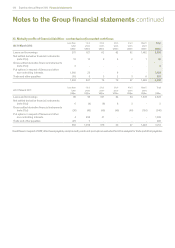

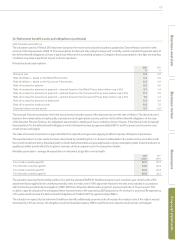

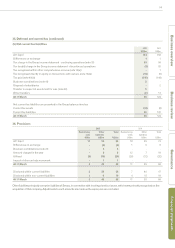

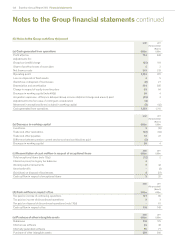

35. Deferred and current tax

(a) Deferred tax

(i) Net deferred tax liabilities

2012

US$m

2011

US$m

At 1 April 121 37

Differences on exchange (14) 8

Tax (credit)/charge in the Group income statement - continuing operations (note 15) (84) 62

Tax charge in the Group income statement - discontinued operations 22

Business combinations (note 41) 73 10

Tax recognised within other comprehensive income (note 16(a)) 230

Tax recognised directly in equity on transactions with owners (note 16(b)) (5) (15)

Transfer in respect of liabilities held for sale (note 42) (38) -

Other transfers 2(13)

At 31 March 59 121

Net deferred tax liabilities are presented in the Group balance sheet as:

Deferred tax assets (320) (159)

Deferred tax liabilities 379 280

At 31 March 59 121