Experian 2012 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

139

Governance Financial statementsBusiness reviewBusiness overview

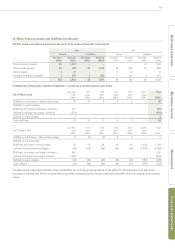

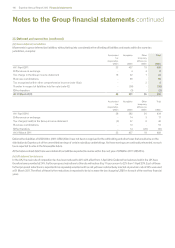

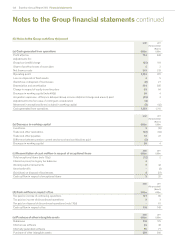

35. Deferred and current tax (continued)

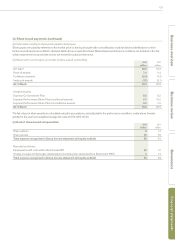

(ii) Gross deferred tax assets

Movements in gross deferred tax assets, without taking into consideration the offsetting of assets and liabilities within the same tax jurisdiction,

comprise:

Accelerated

depreciation

US$m

Intangibles

US$m

Share

incentive

plans

US$m

Tax losses

US$m

Other

temporary

differences

US$m

Total

US$m

At 1 April 2011 8 26 56 117 161 368

Differences on exchange - - - - 22 22

Tax credit/(charge) in the Group income statement 16 (2) (3) 183 (64) 130

Business combinations (note 41) - - - - 26 26

Tax recognised directly in equity on transactions with

owners - - 5 - - 5

Other transfers - - - - (5) (5)

At 31 March 2012 24 24 58 300 140 546

Accelerated

depreciation

US$m

Intangibles

US$m

Share

incentive

plans

US$m

Tax losses

US$m

Other

temporary

differences

US$m

Total

US$m

At 1 April 2010 20 62 39 118 158 397

Differences on exchange 1 - - - 8 9

Tax credit/(charge) in the Group income statement (13) (36) 2 8 15 (24)

Tax recognised within other comprehensive income - - - - (30) (30)

Tax recognised directly in equity on transactions with

owners - - 15 - - 15

Other transfers - - - (9) 10 1

At 31 March 2011 8 26 56 117 161 368

Deferred tax assets are recognised in respect of tax losses carried forward and other temporary differences to the extent that the realisation of

the related tax benefit through future taxable profits is probable.

The Group has not recognised deferred tax assets of US$123m (2011: US$289m) in respect of losses that can be carried forward against future

taxable income and deferred tax assets of US$15m (2011: US$17m) in respect of capital losses that can be carried forward against future taxable

gains. These losses are available indefinitely.

At the balance sheet date there were deferred tax assets expected to reverse within the next year of US$90m (2011: US$71m).