Experian 2012 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32 Experian Annual Report 2012 Business review

Credit Services

Total revenue growth was 10% and organic

revenue growth was 7%, our strongest

performance in four years. In consumer

information, we benefited from steady

recovery in lending activity and from the

introduction of new sources of data and

products to monitor credit risk. Combined,

this drove volume growth in prospecting,

origination and customer management

activities. Business information performed

strongly, with further adoption of our recent

product and technology introductions,

which have been well-received in the

marketplace. We further extended our

position in new customer segments, with

good growth in the automotive vertical,

and we saw good progress in healthcare

payments, as our clients adopt new

analytical tools such as scoring and we

secured major new wins amongst hospitals

and physician practices.

Decision Analytics

We delivered strong growth in Decision

Analytics as the buying cycle for new

software and analytical tools continues

to unfold in response to new regulatory

requirements for lenders. Total and organic

revenue growth was 14%; revenue benefited

as we launched our next-generation

software modules, and as we further

expanded our fraud prevention range.

Marketing Services

Total and organic revenue growth was

8%. There was good growth across

Experian’s digital platforms during the year

as marketers continue to shift spend to

targeted digital marketing tools. Growth

in the year primarily reflected higher

email volumes and new business wins

for the supply of contact data. There was

also further development of our digital

advertising services, which delivered very

strong growth from a low base.

Interactive

Total revenue growth was 10%, with organic

revenue growth of 3%. This reflected growth

across our core credit reference and identity

protection brands, improvement in retention

rates and growth across the white-label

(affinity) channel. Together, these helped to

offset a decline in subscribers for the legacy

brand, freecreditreport.com.

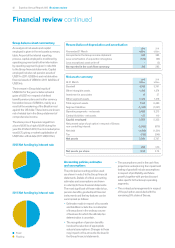

EBIT and margin

For continuing activities, North America

EBIT was US$658m, up 18%. EBIT margin

was 31.5%, an increase of 230 basis points

year-on-year, reflecting positive operating

leverage across all areas of activity.

North America review

Total revenue from continuing activities in North America was US$2,092m,

up 10%, with organic revenue growth of 6%. The difference relates primarily

to the acquisitions of Mighty Net (acquired September 2010) and Medical

Present Value (acquired June 2011).

Victor Nichols

Chief Executive Officer,

North America

“Our investments in recent years

are now starting to pay off as the

North American economy slowly

picks up. We’re particularly pleased

with our progress in new sectors,

such as healthcare payments and

automotive, and by our growth in

the business information market.

We’re also continuing to benefit

from the shift to digital marketing

tools and our new Consumer Direct

brands are now firmly established.”