Experian 2012 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2012 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

136 Experian Annual Report 2012 Financial statements

Notes to the Group financial statements continued

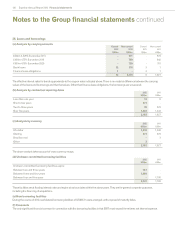

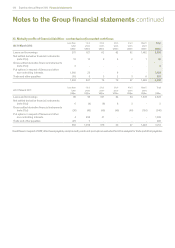

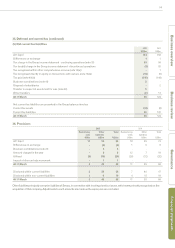

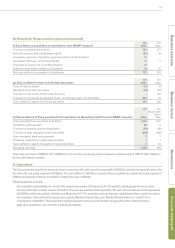

34. Retirement benefit assets and obligations (continued)

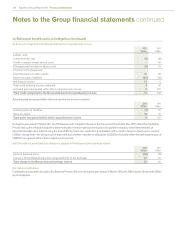

(v) Amounts recognised in the Group statement of comprehensive income

2012

US$m

2011

US$m

Labour costs:

Current service cost (9) (10)

Credit in respect of past service costs - 29

(Charge)/credit included in labour costs (9) 19

Finance income/(expense):

Expected return on plans’ assets 57 56

Interest on plans’ liabilities (46) (50)

Net finance income 11 6

Total credit to Group income statement 2 25

Actuarial gains recognised within other comprehensive income 9 107

Total credit recognised in the Group statement of comprehensive income 11 132

Actuarial gains recognised within other comprehensive income comprise:

2012

US$m

2011

US$m

(Losses)/gains on liabilities (7) 97

Gains on assets 16 10

Total gains recognised within other comprehensive income 9 107

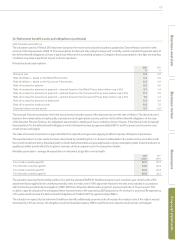

During the year ended 31 March 2011, the UK Government changed to the use of the Consumer Prices Index (the ‘CPI’) rather than the Retail

Prices Index as the inflation measure for determining the minimum pension increases to be applied to statutory index-linked features of

retirement benefits. As a result of using the lower CPI rate, there was a reduction in obligations with a credit in respect of past service costs of

US$29m recognised in the Group income statement and a further reduction in obligations of US$18m included within the total actuarial gain of

US$107m recognised within other comprehensive income.

(vi) Cumulative actuarial gains and losses recognised in the Group retained earnings reserve

2012

US$m

2011

US$m

Gains in Experian plans (28) (19)

Losses in Home Retail Group plans recognised prior to the demerger 81 81

Total charge to the Group retained earnings reserve 53 62

(vii) Future contributions

Contributions expected to be paid to the Experian Pension Scheme during the year ending 31 March 2013 are US$9m by the Group and US$4m

by its employees.