ICICI Bank 2005 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F38

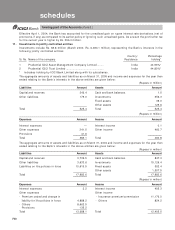

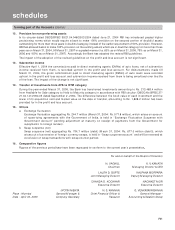

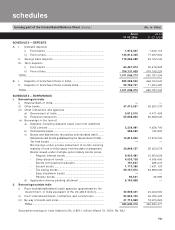

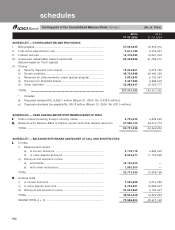

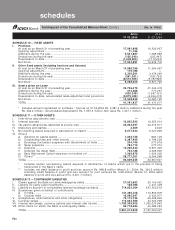

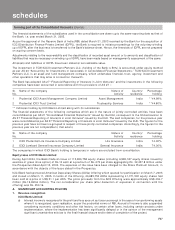

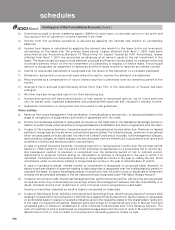

Significant Accounting Policies and Notes to Accounts (refer Schedule 18)

The Schedules referred to above form an integral part of the consolidated balance sheet

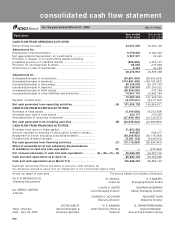

consolidated cash flow statement

for the year ended March 31, 2005

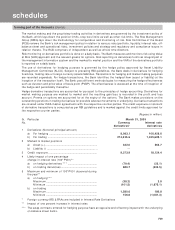

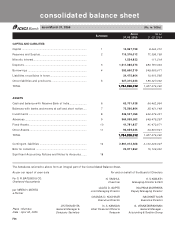

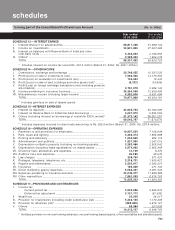

Particulars Year ended Year ended

31.03.2005 31.03.2004

CASH FLOW FROM OPERATING ACTIVITIES

Net profit before taxes ........................................................................ 24,207,093 19,202,139

Adjustments for :

Depreciation and amortisation ........................................................... 9,778,945 9,483,046

Net (appreciation)/depreciation on investments .............................. 5,287,521 76,365

Provision in respect of non-performing assets (including

prudential provision on standard assets) .......................................... (889,859) 4,873,127

Provision for contingencies & others ................................................. 85,984 207,936

(Profit)/loss on sale of fixed assets .................................................... 9,232 32,785

38,478,916 33,875,398

Adjustments for :

(Increase)/decrease in investments ................................................... (50,851,844) (58,802,554)

(Increase)/decrease in advances ........................................................ (313,691,838) (109,741,682)

Increase/(decrease) in borrowings ..................................................... 60,236,038 64,173,144

Increase/(decrease) in deposits.......................................................... 330,298,939 201,280,322

(Increase)/decrease in other assets ................................................... (28,306,093) 573,749

Increase/(decrease) in other liabilities and provisions ..................... 74,907,141 23,945,784

72,592,343 121,428,763

Payment of taxes (net)......................................................................... (9,475,531) (9,317,190)

Net cash generated from operating activities .............................. (A) 101,595,728 145,986,971

CASH FLOW FROM INVESTING ACTIVITIES

Purchase of fixed assets ..................................................................... (5,914,656) (6,227,868)

Proceeds from sale of fixed assets .................................................... 323,177 372,836

(Purchase)/Sale of long term investment .......................................... (37,444,165) (18,135,921)

Net cash generated from investing activities ............................... (B) (43,035,644) (23,990,953)

CASH FLOW FROM FINANCING ACTIVITIES

Proceeds from issue of share capital ................................................ 31,922,933 —

Amount received on exercise of stock option & calls in arrears ..... 649,861 539,077

Repayment of bonds (including subordinated debts)...................... (38,366,923) (92,119,083)

Dividend and dividend tax paid .......................................................... (6,381,725) (5,354,941)

Net cash generated from financing activities................................ (C) (12,175,854) (96,934,947)

Effect of consolidation of new subsidiary/ deconsolidation

of subsidiary on cash and cash equivalents................................... (D) — (673,965)

Net increase/(decrease) in cash and cash equivalents................ (A) + (B) + (C) + (D) 46,384,230 24,387,106

Cash and cash equivalents as at April 1st ...................................... 89,884,102 65,496,996

Cash and cash equivalents as at March 31st ................................ 136,268,332 89,884,102

(Rs. in ’000s)

JYOTIN MEHTA

General Manager &

Company Secretary

For S. R. BATLIBOI & CO.

Chartered Accountants

per VIREN H. MEHTA

a Partner

Place : Mumbai

Date : April 30, 2005

As per our report of even date For and on behalf of the Board of Directors

N. VAGHUL

Chairman

LALITA D. GUPTE

Joint Managing Director

CHANDA D. KOCHHAR

Executive Director

N. S. KANNAN

Chief Financial Officer &

Treasurer

K. V. KAMATH

Managing Director & CEO

KALPANA MORPARIA

Deputy Managing Director

NACHIKET MOR

Executive Director

G. VENKATAKRISHNAN

General Manager -

Accounting & Taxation Group