ICICI Bank 2005 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

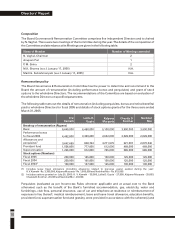

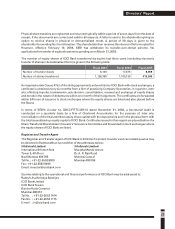

composition of the Committee and attendance at its Meetings are given in the following table:

VIII. Fraud Monitoring Committee

Terms of reference

The Committee monitors and reviews all frauds involving Rs. 10.0 million and above.

Composition

The Fraud Monitoring Committee comprises five Directors, namely, Uday M. Chitale, M. K. Sharma, K. V.

Kamath, Kalpana Morparia and Chanda D. Kochhar and is chaired by Uday M. Chitale.

There was one Meeting of the Committee during the year which was attended by all the members of the

Committee.

IX. Risk Committee

Terms of reference

The Committee reviews ICICI Bank’s risk management policies in relation to various risks (credit, portfolio,

liquidity, interest rate, off-balance sheet and operational risks), investment policies and strategy and

regulatory and compliance issues in relation thereto.

Composition

The Risk Committee comprises five Directors. It is chaired by N. Vaghul and a majority of its members are

independent Directors. There were four meetings of the Committee during the year. The details of the

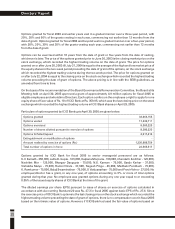

composition of the Committee and attendance at its Meetings are given in the following table:

(1) Also participated in one meeting through tele -conference.

X. Share Transfer & Shareholders’/Investors’ Grievance Committee

Terms of reference

The functions and powers of the Committee include approval and rejection of transfer or transmission of

equity and preference shares, bonds, debentures and securities, issue of duplicate certificates, allotment

of shares and securities issued from time to time, including those under stock options, review and

redressal of shareholders’ and investors’ complaints, delegation of authority for opening and operation of

bank accounts for payment of interest, dividend and redemption of securities and the listing of securities

on stock exchanges.

20

Directors’ Report

Number of Meetings attended

N. Vaghul, Chairman

Somesh R. Sathe

M. K . Sharma (w.e.f. August 1, 2004)

Satish C. Jha (up to September 20, 2004)

K. V. Kamath

Name of Member

6

5

2

1

6

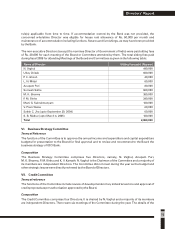

Number of Meetings attended

N. Vaghul, Chairman

Uday M. Chitale

(1)

Marti G. Subrahmanyam

(1)

V. Prem Watsa

K. V. Kamath

Name of Member

4

4

3

1

4

Dickenson Tel: 022-2625 2282