ICICI Bank 2005 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

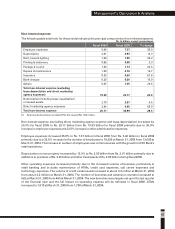

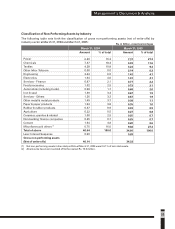

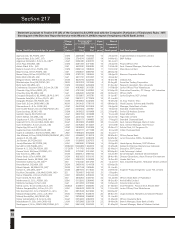

ASSET QUALITY AND COMPOSITION

Loan Portfolio

ICICI Bank follows a strategy of building a diversified and de-risked asset portfolio and limiting or

correcting concentrations in particular sectors. ICICI Bank limits its exposure to any particular industry to

12.0% of its total exposure.

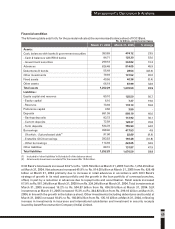

The following table sets forth, at the dates indicated, the composition of ICICI Bank’s loans and advances:

(1) Amount is net of write-offs and gross of provisions.

(2) Includes home loans, automobile loans, commercial business loans, two-wheeler loans, personal loans, credit cards &

others.

(3) All amounts have been rounded off to the nearest Rs. 10.0 million.

Management’s Discussion & Analysis

(2)

Retail loans

Iron & steel

Crude petroleum & refining

Roads, ports, railways and

telecommunications

Services

Chemicals

Power

Metal & metal products

Engineering

Cotton Textiles

Cement

Shipping

Automobiles

Food processing

Paper & paper products

Sugar

Other textiles

Gems & jewellery

Non-banking finance companies

Tea

Construction

Leather & leather products

Other Industries

Total

March 31, 2005

% of total

60.9

5.1

4.7

3.3

3.2

3.0

1.9

1.9

1.8

1.2

1.1

1.0

0.8

0.7

0.6

0.5

0.5

0.3

0.2

0.2

0.2

0.1

6.8

100.0

March 31, 2004

% of total

51.5

7.6

3.0

3.4

3.6

5.1

3.6

2.4

3.7

1.8

1.9

0.6

1.4

0.2

1.1

0.9

0.8

0.2

0.5

0.3

0.3

0.0

6.1

100.0

Loans and

(1)

advances

335.26

49.30

19.70

21.89

23.82

33.36

23.19

15.59

24.00

11.73

12.14

3.79

8.98

1.17

6.85

5.58

4.71

1.27

3.74

1.97

2.05

0.16

38.62

648.87

Loans and

(1)

advances

566.52

47.43

43.67

30.77

29.49

28.03

17.75

17.43

17.17

11.33

10.08

8.73

7.33

6.81

5.43

4.54

4.21

2.66

2.06

2.05

1.46

1.36

64.14

930.45

Rs. in billion, except percentages

Dickenson Tel: 022-2625 2282