ICICI Bank 2005 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

ICICI Bank uses marketing agents, called direct marketing agents or associates, for sourcing retail assets.

The commissions paid to these agents are expensed upfront and not amortised over the life of the loan.

These commissions are included in non-interest expense (other than commissions in respect of

automobile loans, which are reduced from the interest income). ICICI Bank incurred direct marketing

agency expenses of Rs. 4.85 billion on the retail asset portfolio (other than automobile loans) in fiscal 2005

compared to Rs. 2.94 billion in fiscal 2004, with the increase being commensurate with growth in business

volumes.

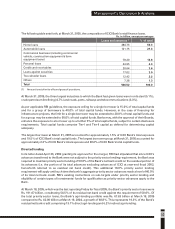

Treasury income

Total income from treasury-related activities decreased 45.9% to Rs. 7.11 billion in fiscal 2005 from

Rs. 13.14 billion in fiscal 2004 primarily due to the adverse conditions in the fixed income markets. Capital

gains from proprietary trading and the government securities portfolio were adversely affected by the

increase in interest rates during the year. The yield on 10-year benchmark government securities had

increased from 5.16% at March 31, 2004 to a high of 7.30% at November 8, 2004 and was 6.66% at

March 31, 2005, an increase of 150 basis points over the March 31, 2004 level. Capital gains on shares was

Rs. 4.61 billion for fiscal 2005 compared to Rs. 3.97 billion for fiscal 2004, as ICICI Bank continued to

capitalise on the opportunities created by the buoyant equity markets. These shares were acquired

primarily at the time of the initial project finance assistance as well as on conversion of loans into shares as

a part of restructuring of debt.

During fiscal 2005, the Bank transferred Statutory Liquidity Ratio (SLR) investments amounting to

Rs. 213.49 billion from the “Available For Sale” (AFS) category to the “Held To Maturity” (HTM) category

pursuant to Reserve Bank of India’s circular DBOD. No. BP.BC.37/21.04.141/2004-05 dated September 2,

2004. As required by the above circular, a provision of Rs. 1.83 billion being the difference between the

book value of each investment and the lower of its acquisition cost and market value was made.

Subsequent to the transfer, the Bank’s SLR portfolio is predominantly categorized as HTM thereby

insulating the income statement from negative mark-to-market impact on this portfolio in the event of

adverse movement in interest rates.

Provisions & tax

Provisions decreased 25.9% to Rs. 4.29 billion in fiscal 2005 from Rs. 5.79 billion in fiscal 2004, due to a

higher level of write -backs. Income tax increased 97.0% to Rs. 5.22 billion in fiscal 2005 from Rs. 2.65

billion in fiscal 2004 as the effective income tax rate increased to 20.7% in fiscal 2005 from 13.9% in fiscal

2004. The lower effective tax rate in earlier years was due to the deferred tax benefit on utilisation of fair

value provisions created at the time of the amalgamation of ICICI with ICICI Bank. The effective income tax

rate continued to be lower than the statutory rates for fiscal 2005 primarily due to exempt interest and

dividend income and the charging of certain income at rates other than the statutory rate, offset in part, by

the disallowance of certain expenses for tax purposes.

Management’s Discussion & Analysis

Dickenson Tel: 022-2625 2282