ICICI Bank 2005 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Physical share transfers are registered and returned typically within a period of seven days from the date of

receipt, if the documents are correct and valid in all respects. A letter is sent to the shareholder giving an

option to receive shares in physical or dematerialised mode. A period of 30 days is given to the

shareholder for sending his / her intimation. The shareholder then receives the shares in the form opted for.

However, effective February 10, 2004, SEBI has withdrawn its transfer-cum-demat scheme. No

applications for transfer of equity shares were pending as on March 31, 2005.

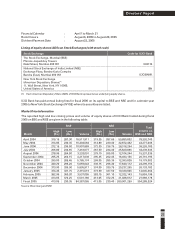

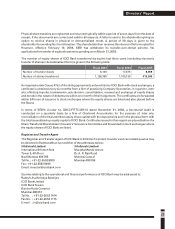

The number of equity shares of ICICI Bank transferred during the last three years (excluding electronic

transfer of shares in dematerialised form) is given in the following table:

As required under Clause 47(c) of the listing agreements entered into by ICICI Bank with stock exchanges, a

certificate is obtained every six months from a firm of practicing Company Secretaries, in regard to, inter

alia, effecting transfer, transmission, sub-division, consolidation, renewal and exchange of equity shares

and bonds in the nature of debentures within one month of their lodgement. The certificates are forwarded

within 24 hours of issuance to stock exchanges where the equity shares are listed and also placed before

the Board.

In terms of SEBI’s circular no. D&CC/FITTC/CIR-16 dated December 31, 2002, a Secretarial Audit is

conducted on a quarterly basis by a firm of Chartered Accountants, for the purpose of, inter alia,

reconciliation of the total admitted equity share capital with the depositories and in the physical form with

the total issued/paid up equity capital of ICICI Bank. Certificates issued in this regard are placed before the

Share Transfer & Shareholders’/Investors’ Grievance Committee and forwarded to stock exchanges where

the equity shares of ICICI Bank are listed.

Registrar and Transfer Agent

The Registrar and Transfer Agent of ICICI Bank is 3i Infotech Limited. Investor services related queries may

be directed to Padmanabhan Iyer at either of the addresses below:

3i Infotech Limited 3i Infotech Limited

International Infotech Park Maratha Mandir Annex

Tower 5, 4th Floor Dr. A. R. Nair Road

Navi Mumbai 400 705 Mumbai Central

Tel No.: +91-22-5592 8000 Mumbai 400 008

Fax: +91-22-5592 8099

Email: [email protected]

Queries relating to the operational and financial performance of ICICI Bank may be addressed to:

Rakesh Jha/Anindya Banerjee

ICICI Bank Limited

ICICI Bank Towers

Bandra-Kurla Complex

Mumbai 400 051

Tel No. : +91-22-2653 1414

Fax No. : +91-22-2653 1175

25

Fiscal 2005

Number of transfer deeds

Number of shares transferred

8,059

413,245

Fiscal 2003 Fiscal 2004

17,675

1,105,135

8,140

1,126,355

Directors’ Report

Dickenson Tel: 022-2625 2282