ICICI Bank 2005 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F43

schedules

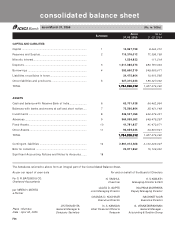

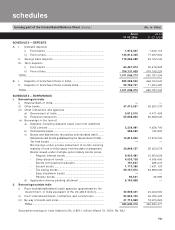

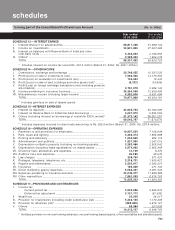

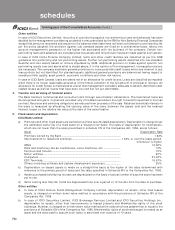

SCHEDULE 8 — INVESTMENTS [net of provisions]

I. Investments in India

i) Government securities.................................................................... 359,865,891 318,418,688

ii) Other approved securities............................................................... 318,890 301,155

iii) Shares................................................................................................ 32,027,936 29,491,736

iv) Debentures and bonds .................................................................... 35,035,525 64,916,056

v) Associates......................................................................................... 13,311 13,298

vi) Others (CPs, Mutual Fund Units, Pass through Certificates,

Security Receipts etc.)* ................................................................... 101,247,552 49,122,733

TOTAL ........................................................................................................ 528,509,105 462,263,666

II. Investments outside India

i) Government securities.................................................................... 377,947 132,924

ii) Others................................................................................................ 17,640,214 277,861

TOTAL ........................................................................................................ 18,018,161 410,785

GRAND TOTAL (I + II)............................................................................... 546,527,266 462,674,451

* Includes assets held to cover linked liabilities of life insurance business of Rs. 26,540.6 million

(March 31, 2004: Rs. 8,650.0 million).

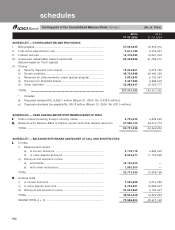

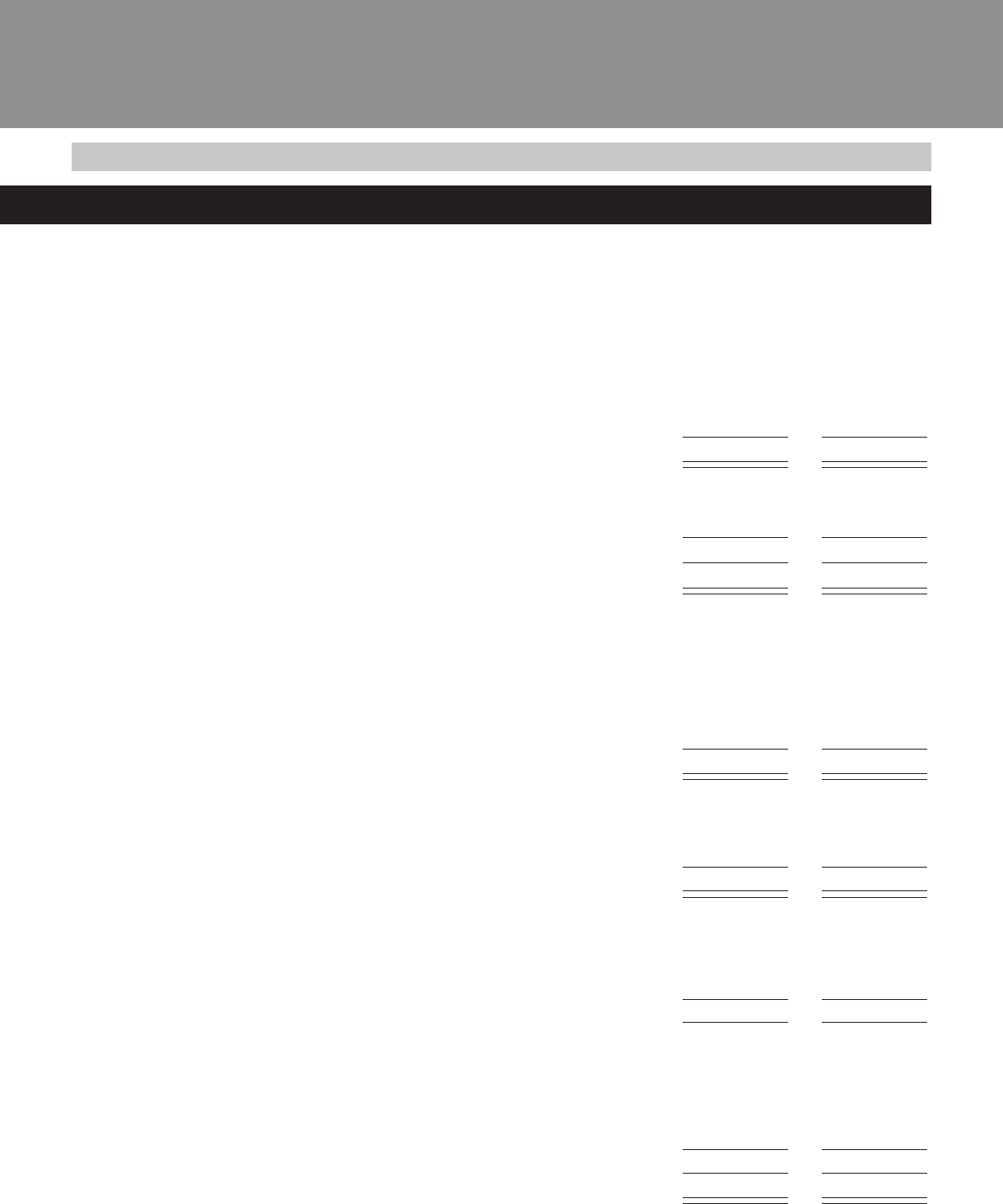

SCHEDULE 9 — ADVANCES [net of provisions]

A.A.

A.A.

A. i) Bills purchased and discounted ..................................................... 43,984,209 12,308,603

ii) Cash credits, overdrafts and loans repayable on demand ........... 123,344,410 61,254,576

iii) Term loans ........................................................................................ 772,559,072 562,465,620

iv) Securitisation, finance lease and hire purchase receivables* .... 24,211,871 13,450,498

TOTAL ....................................................................................................................................................................................

....................................................................................................................................................................................

.......................................................................................... 964,099,562 649,479,297

B.B.

B.B.

B. i) Secured by tangible assets

[includes advances against book debt] .......................................... 827,679,644 598,586,829

ii) Covered by Bank/Government guarantees ................................... 10,795,838 6,709,389

iii) Unsecured ........................................................................................ 125,624,080 44,183,079

TOTAL ........................................................................................................ 964,099,562 649,479,297

C.C.

C.C.

C. I.I.

I.I.

I. Advances in India .............................................................................

i) Priority sector ........................................................................... 215,591,362 145,307,396

ii) Public sector ............................................................................. 11,154,310 7,071,294

iii) Banks ......................................................................................... 4,517,162 433,504

iv) Others........................................................................................ 650,547,563 484,927,584

TOTAL ........................................................................................................ 881,810,397 637,739,778

II.II.

II.II.

II. Advances outside India

i) Due from banks ........................................................................ 10,375,851 —

ii) Due from others

a) Bills purchased and discounted ..................................... 24,884,221 5,958,406

b) Syndicated loans .............................................................. 11,925,394 1,962,537

c) Others................................................................................ 35,103,699 3,818,576

TOTAL ........................................................................................................ 82,289,165 11,739,519

GRAND TOTAL (C. I and II) ....................................................................... 964,099,562 649,479,297

* Includes receivables under lease amounting to Rs. 913.6 million (March 31, 2004 : Rs. 1,417.8 million)

As on As on

31.03.2005 31.03.2004

(Rs. in ‘000s)

forming part of the Consolidated Balance Sheet (Contd.)