ICICI Bank 2005 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F52

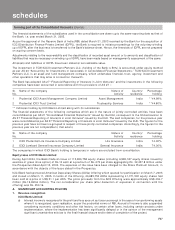

Other entities

In case of ICICI Securities Limited, the policy of provisioning against non performing loans and advances has been

decided by the management considering prudential norms prescribed by the RBI for Non Banking Financial Companies

except that amounts recovered subsequent to the balance sheet date have not been considered for provisioning. As

per the policy adopted, the provision against sub standard assets are fixed on a conservative basis, taking into

account management's perception of the higher risk associated with the business of the company. Certain non-

performing loans and advances are considered as loss assets and full provision has been made against such assets.

In case of ICICI Home Finance Company Limited, loans and other credit facilities are classified as per the NHB

guidelines into performing and non-performing assets. Further non-performing assets classified into sub standard,

doubtful and loss assets based on criteria stipulated by NHB. Additional provision is made against specific non

performing assets over and above what is stated above, if in the opinion of the management, increased provisions

are necessary. The company maintains general provisions to cover potential credit losses which are inherent in any

loan portfolio but not identified. For standard assets, additional general provisions are determined having regard to

overall portfolio quality, asset growth, economic conditions and other risk factors.

In case of ICICI Bank Canada, loans are stated net of an allowance for credit losses. Loans are classified as impaired

when there is no longer reasonable assurance of the timely collection of the full amount of principal or interest. An

allowance for credit losses is maintained at a level that management considers adequate to absorb identified credit

related losses as well as losses that have been incurred but not yet identifiable.

4. Transfer and servicing of financial assets

The Bank transfers commercial and consumer loans through securitisation transactions. The transferred loans are

de-recognised and gains / losses are recorded only if the Bank surrenders the right to benefits specified in the loan

contract. Recourse and servicing obligations are reduced from proceeds of the sale. Retained beneficial interests in

the loans is measured by allocating the carrying value of the loans between the assets sold and the retained

interest, based on the relative fair value at the date of the securitisation.

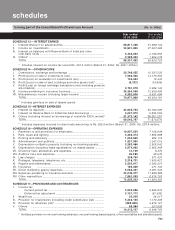

5. Fixed assets and depreciation

ICICI Bank Limited

a) Premises and other fixed assets are carried at cost less accumulated depreciation. Depreciation is charged over

the estimated useful life of a fixed asset on a "straight line" basis. The rates of depreciation for fixed assets,

which are not lower than the rates prescribed in schedule XIV of the Companies Act, 1956, are as follows:

Asset Depreciation Rate

Premises owned by the Bank ................................................................................ 1.63%

Improvements to leasehold premises .................................................................. 1.63% or over the lease period,

whichever is higher

ATMs 12.50%

Plant and machinery like air conditioners, xerox machines, etc........................ 10%

Furniture and fixtures ............................................................................................. 15%

Motor vehicles......................................................................................................... 20%

Computers ............................................................................................................... 33.33%

EDC Terminals ......................................................................................................... 16.67%

Others (including software and system development expenses) ..................... 25%

b) Depreciation on leased assets is made on a straight-line basis at the higher of the rates determined with

reference to the primary period of lease and the rates specified in Schedule XIV to the Companies Act, 1956.

c) Assets purchased/sold during the year are depreciated on the basis of actual number of days the asset has been

put to use.

d) Items costing less than Rs. 5,000 are depreciated fully over a period of 12 months from the date of purchase.

Other entities

a) In case of ICICI Venture Funds Management Company Limited, depreciation on assets, other than leased

assets, is charged on written down value method in accordance with the provisions of Schedule XIV of the

Companies Act, 1956.

b) In case of ICICI Securities Limited, ICICI Brokerage Services Limited,and ICICI Securities Holdings Inc.,

depreciation on assets, other than improvements to leased property and Membership rights of the stock

exchange, Mumbai, is charged on written down value method at the rates which are greater than or equal to the

provisions of Schedule XIV of the Companies Act, 1956. Membership rights of stock exchanges is treated as an

asset and the value paid to acquire such rights is amortized over a period of 10 years.

schedules

forming part of the Consolidated Accounts (Contd.)