ICICI Bank 2005 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

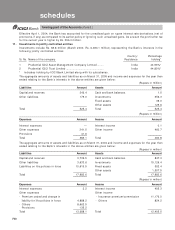

F31

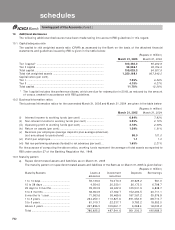

12. Provision for non-performing assets

In its circular dated DBOD.BP.BC 99/21.04.048/2003-2004 dated June 21, 2004 RBI has introduced graded higher

provisioning norms which would require a bank to make 100% provision on the secured portion of doubtful assets

outstanding for more than three years in doubtful category instead of the earlier requirement of 50% provision. However,

RBI has allowed banks to make 100% provision on the existing assets which are in doubtful category for more than three

years as on March 31, 2004, till March 31, 2007 in a graded manner (i.e. 60% as on March 31, 2005, 75% as on March 31,

2006 and 100% as on March 31, 2007). Accordingly the Bank has adopted the revised RBI guidelines.

The impact of the adoption of the revised guidelines on the profit and loss account is not significant.

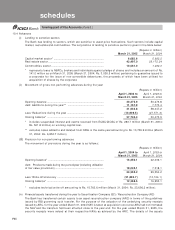

13. Subvention income

Effective April 1, 2004 the commissions paid to direct marketing agents (DMAs) of auto loans, net of subvention

income received from them, is recorded upfront in the profit and loss account. For disbursements made till

March 31, 2004, the gross commissions paid to direct marketing agents (DMAs) of auto loans were recorded

upfront in the profit and loss account and subvention income received from them is being amortised over the life

of the loan. The impact of the change is not significant.

14. Transfer of investments from AFS to HTM category

During the year ended March 31, 2005, the Bank has transferred investments amounting to Rs. 213,489.4 million

from Available for Sale category to Held to Maturity category in accordance with RBI circular: DBOD.No.BP.BC.37/

21.04.141/2004-05 dated September 2, 2004. The difference between the book value of each investment and the

lower of its acquisition cost and market value on the date of transfer, amounting to Rs. 1,828.2 million has been

provided for in the profit and loss account.

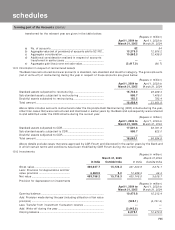

15. Others

a. Exchange fluctuation

Exchange fluctuation aggregating Rs. 244.7 million (March 31, 2004: Rs. 577.8 million), which arises on account

of rupee-tying agreements with the Government of India, is held in “Exchange Fluctuation Suspense with

Government Account” pending adjustment at maturity on receipt of payments from the Government for

repayments to foreign lenders.

b. Swap suspense (net)

Swap suspense (net) aggregating Rs. 794.7 million (debit) (March 31, 2004: Rs. 677.0 million (debit)), which

arises out of conversion of foreign currency swaps, is held in “Swap suspense account” and will be reversed at

conclusion of swap transactions with swap counter parties.

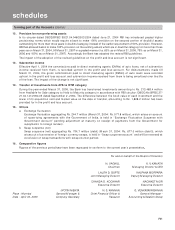

16. Comparative figures

Figures of the previous period/year have been regrouped to conform to the current year’s presentation..

..

.

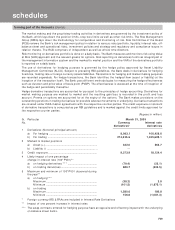

For and on behalf of the Board of Directors

N. VAGHUL

Chairman

LALITA D. GUPTE

Joint Managing Director

CHANDA D. KOCHHAR

Executive Director

N. S. KANNAN

Chief Financial Officer &

Treasurer

K. V. KAMATH

Managing Director & CEO

KALPANA MORPARIA

Deputy Managing Director

NACHIKET MOR

Executive Director

G. VENKATAKRISHNAN

General Manager -

Accounting & Taxation Group

JYOTIN MEHTA

General Manager &

Company Secretary

Place : Mumbai

Date : April 30, 2005

forming part of the Accounts (Contd.)

schedules