ICICI Bank 2005 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F64

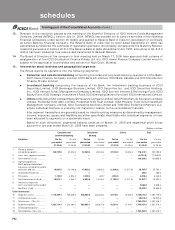

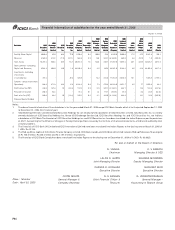

Financial information of subsidiaries for the year ended March 31, 2005

Rupees in million

ICICIICICI

ICICIICICI

ICICI ICICIICICI

ICICIICICI

ICICI ICICIICICI

ICICIICICI

ICICI ICICIICICI

ICICIICICI

ICICI

ICICIICICI

ICICIICICI

ICICI InvestmentInvestment

InvestmentInvestment

Investment VentureVenture

VentureVenture

Venture ICICIICICI

ICICIICICI

ICICI LombardLombard

LombardLombard

Lombard DistriDistri

DistriDistri

Distri--

--

-

ICICIICICI

ICICIICICI

ICICI ICICIICICI

ICICIICICI

ICICI HomeHome

HomeHome

Home ICICIICICI

ICICIICICI

ICICI Manage-Manage-

Manage-Manage-

Manage- FundsFunds

FundsFunds

Funds PrudentialPrudential

PrudentialPrudential

Prudential GeneralGeneral

GeneralGeneral

General ICICIICICI

ICICIICICI

ICICI butionbution

butionbution

bution ICICIICICI

ICICIICICI

ICICI

ParticularsParticulars

ParticularsParticulars

Particulars ICICIICICI

ICICIICICI

ICICI BrokerageBrokerage

BrokerageBrokerage

Brokerage ICICIICICI

ICICIICICI

ICICI SecuritiesSecurities

SecuritiesSecurities

Securities FinanceFinance

FinanceFinance

Finance TrusteeshipTrusteeship

TrusteeshipTrusteeship

Trusteeship mentment

mentment

ment

ManagementM anagement

ManagementM anagement

Management

LifeLife

LifeLife

Life InsuranceInsurance

InsuranceInsurance

Insurance Inter Inter

Inter Inter

Inter--

--

-FinanceFinance

FinanceFinance

Finance BankBank

BankBank

Bank

ICICIICICI

ICICIICICI

ICICI

SecuritiesSecurities

SecuritiesSecurities

Securities ServicesServices

ServicesServices

Services SecuritiesSecurities

SecuritiesSecurities

Securities HoldingsHoldings

HoldingsHoldings

Holdings CompanyCompany

CompanyCompany

Company ServicesServices

ServicesServices

Services CompanyCompany

CompanyCompany

Company CompanyCompany

CompanyCompany

Company InsuranceInsurance

InsuranceInsurance

Insurance CompanyCompany

CompanyCompany

Company nationalnational

nationalnational

national PrivatePrivate

PrivatePrivate

Private UKUK

UKUK

UK

BankBank

BankBank

Bank

LimitedLimited

LimitedLimited

Limited LimitedLimited

LimitedLimited

Limited Inc.Inc.

Inc.Inc.

Inc. Inc. Inc.

Inc. Inc.

Inc. LimitedLimited

LimitedLimited

Limited LimitedLimited

LimitedLimited

Limited LimitedLimited

LimitedLimited

Limited LimitedLimited

LimitedLimited

Limited CompanyCompany

CompanyCompany

Company LimitedLimited

LimitedLimited

Limited LimitedLimited

LimitedLimited

Limited LimitedLimited

LimitedLimited

Limited LimitedLimited

LimitedLimited

Limited

CanadaCanada

CanadaCanada

Canada

Paid-Up Share Capital 2,030.0 45.0 48.3 75.0 1,550.0 0.5 100.0 23.4 9,250.0 2,200.0 17.5 87.5 6,561.8 902.1

Reserves 2,160.6 419.2 (7.8) (21.1) 365.5 0.8 18.0 343.1 (6,332.0) 360.6 5.6 451.0 1.0 (205.0)

Total Assets 13,727.5 866.2 54.5 55.7 30,911.9 1.6 122.5 486.7 41,269.0 7,689.2 25.7 629.8 44,565.7 4,514.9

Total Liabilities (excluding

Capital and Reserves) 9,536.9 402.0 14.0 1.8 28,996.4 0.3 4.5 120.2 38,351.0 5,128.6 2.6 91.3 38,002.9 3,817.8

Investments (excluding

investments

in subsidiaries) 721.5 - - 48.3 320.5 - 14.4 231.0 11,254.9 4,640.9 13.1 - 7,365.8 2,189.5

Turnover - (Gross Income from

Operations) 564.8 471.3 43.3 6.9 2,314.8 0.3 7.3 676.3 24,294.0 8,851.7 4.5 7.7 1,002.3 64.6

Profit before Tax (PBT) 844.6 137.6 1.0 (13.4) 137.6 0.3 3.5 501.1 (2,224.1) 538.7 - 19.5 124.2 (287.6)

Provision for Taxation 280.6 53.2 - - 37.5 0.1 1.4 177.1 (107.9) 55.3 - 3.4 24.9 (82.6)

Profit after Tax (PAT) 564.0 84.4 1.0 (13.4) 100.1 0.2 2.1 324.0 (2,116.2) 483.4 - 16.1 99.3 (205.0)

Proposed Equity Dividend - - - - - - - - - - - - - -

Notes:

1. The above financial information of the subsidiaries is for the year ended March 31, 2005 except ICICI Bank Canada, which is for the period September 12, 2003

to December 31, 2004 (first financial year).

2. ICICI Brokerage Services Limited and ICICI Securities Holdings Inc. are wholly owned subsidiaries of ICICI Securities Limited. ICICI Securities Inc. is a wholly

owned subsidiary of ICICI Securities Holdings Inc. Hence ICICI Brokerage Services Ltd, ICICI Securities Holdings Inc. and ICICI Securities Inc. are indirect

subsidiaries of ICICI Bank.The financials of ICICI Securities Holdings Inc. and ICICI Securities Inc. have been translated into Indian Rupees as per the provisions

of AS-11-Accounting for the Effects of changes in Foreign Exchange Rates issued by the Institute of Chartered Accountants of India and audited by their

statutory auditors.

3. The financials of ICICI Bank UK Limited and ICICI International Limited have been translated into Indian Rupees at the closing rate on March 31,2005 of

1 USD= Rs 43.745.

4. The Paid-up Share capital of ICICI Home Finance Company Limited, ICICI Bank Canada and ICICI Bank UK Limited includes Paid-up Preference Share capital

of Rs 150.0 million, Rs 335.2 million and Rs 2,187.3 million, respectively.

5. The financials of ICICI Bank Canada have been translated into Indian Rupees at the closing rate on December 31, 2004 of 1 CAD= Rs 36.0825

JYOTIN MEHTA

General Manager &

Company Secretary

Place : Mumbai

Date : April 30, 2005

For and on behalf of the Board of Directors

N. VAGHUL

Chairman

LALITA D. GUPTE

Joint Managing Director

CHANDA D. KOCHHAR

Executive Director

N. S. KANNAN

Chief Financial Officer &

Treasurer

K. V. KAMATH

Managing Director & CEO

KALPANA MORPARIA

Deputy Managing Director

NACHIKET MOR

Executive Director

G. VENKATAKRISHNAN

General Manager -

Accounting & Taxation Group