ICICI Bank 2005 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

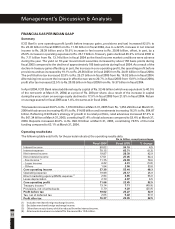

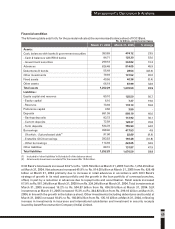

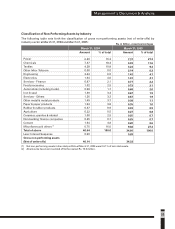

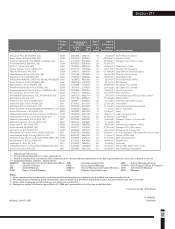

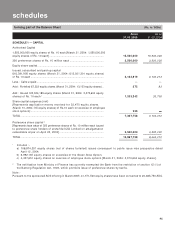

The following table sets forth, at March 31, 2005, the composition of ICICI Bank’s retail finance loans.

(1) Amount is net of write-offs and gross of provisions.

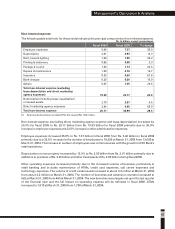

At March 31, 2005, the three largest industries to which the Bank had given loans were iron & steel (5.1%),

crude petroleum & refining (4.7%) and roads, ports, railways and telecommunications (3.3%).

As per applicable RBI guidelines, the exposure ceiling for a single borrower is 15.0% of total capital funds

and for a group of borrowers is 40.0% of total capital funds. However, in the case of financing for

infrastructure projects, the limit for a single borrower may be extended to 20.0% of total capital funds and

for a group may be extended to 50.0% of total capital funds. Banks may, with the approval of their Boards,

enhance the exposure to a borrower up to a further 5% of total capital funds, subject to certain disclosure

requirements. Total capital funds comprise Tier-I and Tier-II capital as defined for determining capital

adequacy.

The largest borrower at March 31, 2005 accounted for approximately 1.5% of ICICI Bank’s total exposure

and 19.5% of ICICI Bank’s total capital funds. The largest borrower group at March 31, 2005 accounted for

approximately 2.3% of ICICI Bank’s total exposure and 30.6% of ICICI Bank’s total capital funds.

Directed lending

In its letter dated April 26, 2002 granting its approval for the merger, RBI had stipulated that since ICICI’s

advances transferred to the Bank were not subject to the priority sector lending requirement, the Bank was

required to maintain priority sector lending of 50.0% of the Bank’s net bank credit on the residual portion of

its advances (i.e. the portion of its total advances excluding advances of ICICI at year-end fiscal 2002,

henceforth referred to as residual net bank credit). This additional 10.0% priority sector lending

requirement will apply until such time the bank’s aggregate priority sector advances reach a level of 40.0%

of its total net bank credit. RBI’s existing instructions on sub-targets under priority sector lending and

eligibility of certain types of investments/ funds for qualification as priority sector advances apply to the

Bank.

At March 18, 2005, which was the last reporting Friday for fiscal 2005, the Bank’s priority sector loans were

Rs. 191.07 billion, constituting 54.5% of its residual net bank credit against the requirement of 50.0%. Of

the total priority sector loans, the Bank’s agri-lending portfolio was Rs. 67.63 billion at March 18, 2005

compared to Rs. 42.06 billion at March 19, 2004, a growth of 60.8%. This represents 19.3% of the Bank’s

residual net bank credit comprising 13.1% direct agri-lending and 6.2% indirect agri-lending.

Management’s Discussion & Analysis

284.76

121.15

78.20

24.95

20.64

17.02

12.42

7.38

566.52

Home loans

Automobile loans

Commercial business (including commercial

vehicle, construction equipment & farm

equipment loans)

Personal loans

Credit card receivables

Loans against securities

Two-wheeler loans

Others

Total

% of total

50.3

21.4

13.8

4.4

3.6

3.0

2.2

1.3

100.0

(1)

Loans and advances

Rs. in billion, except percentages

Dickenson Tel: 022-2625 2282