ICICI Bank 2005 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

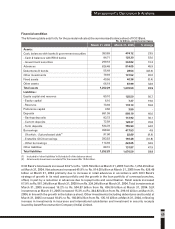

50

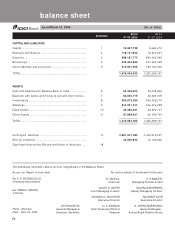

ICICI Bank’s net worth at March 31, 2005 increased to Rs. 124.23 billion (net of unamortised early

retirement option expenses of Rs. 1.27 billion) from Rs. 78.45 billion at March 31, 2004 as a result of the

equity capital of Rs. 32.46 billion raised during the year and the retained profit for the year. Total deposits

increased 46.6% to Rs. 998.19 billion at March 31, 2005 from Rs. 681.09 billion at March 31, 2004. ICICI

Bank’s savings account deposits increased 36.1% to Rs. 113.92 billion at March 31, 2005 from Rs. 83.72

billion at March 31, 2004, while current account deposits increased 76.8% to Rs. 128.37 billion at

March 31, 2005 from Rs. 72.59 billion at March 31, 2004. Term deposits increased by 44.0% to Rs. 755.90

billion at March 31, 2005 from Rs. 524.78 billion at March 31, 2004. Of the term deposits, value-added

savings and current account deposits totaled about Rs. 114.45 billion at March 31, 2005 compared to about

Rs. 100.42 billion at March 31, 2004. Total deposits at March 31, 2005 constituted 70.5% of total funding

(i.e. deposit, borrowings and subordinated debts) compared to 63.1% at March 31, 2004.

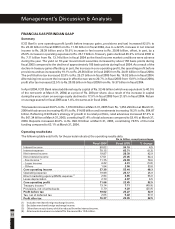

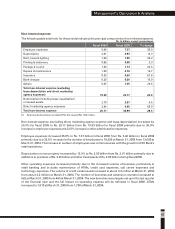

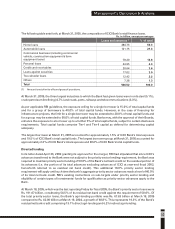

Capital adequacy

ICICI’s Bank’s total capital adequacy at March 31, 2005 was 11.78%, comprising Tier-I capital adequacy of

7.59% and Tier-II capital adequacy of 4.19%. In accordance with RBI guidelines issued in fiscal 2005, a risk

weight of 75% has been assigned to home loans to individuals and 125% to other retail loans at March 31,

2005, compared to 50% and 100% respectively at March 31, 2004. This had a negative impact of 104 basis

points on the total capital adequacy at March 31, 2005. The risk- weighted assets at March 31, 2005 also

include the impact of capital for market risk on the “Held for Trading” (HFT) portfolio. The Investment

Fluctuation Reserve at March 31, 2005 was Rs. 5.16 billion, which was 5% of the fixed income investment

portfolio (excluding Held-to-Maturity category). In line with RBI guidelines, Investment Fluctuation

Reserve is considered in Tier-II capital, and not in Tier-I capital. Deferred tax asset of Rs. 0.15 billion has also

been reduced from Tier-I capital in compliance with the RBI guidelines. In accordance with RBI guidelines,

Tier-I capital includes Rs. 1.55 billion out of the face value of Rs. 3.50 billion of 20 year non-cumulative

preference shares issued to ITC Limited as a part of the scheme for merger of ITC Classic Finance Limited

with ICICI.

CONSOLIDATED ACCOUNTS

The consolidated profit after tax for fiscal 2005 was Rs. 18.52 billion including the results of operations of

ICICI Bank’s subsidiaries and other consolidating entities. Future bonus provisions and non-amortisation

of expenses by ICICI Prudential Life Insurance Company in line with insurance company accounting norms

had a negative impact of Rs. 1.57 billion on the Bank’s consolidated profits. Life insurance companies

worldwide require five to seven years to achieve break-even, in view of the business set-up and customer

acquisition costs in the initial years as well as reserving for actuarial liability. The deficit in the initial years is

usually higher for faster growing companies; the profit streams, after break-even is achieved, are expected

to be correspondingly higher.

Management’s Discussion & Analysis

March 31, 2005

% of Risk-

weighted assets

7.59

4.19

11.78

March 31, 2004

% of Risk-

weighted assets

6.09

4.27

10.36

Amount

55.25

38.76

94.01

907.34

Amount

102.46

56.57

159.03

1,350.17

Rs. in billion, except percentages

Tier I capital

Tier II capital

Total capital

Risk-weighted assets

Dickenson Tel: 022-2625 2282