ICICI Bank 2005 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

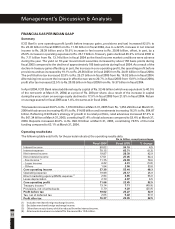

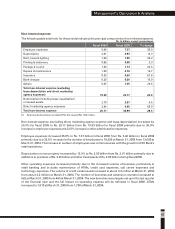

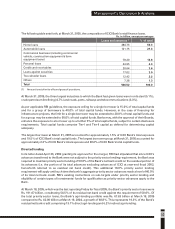

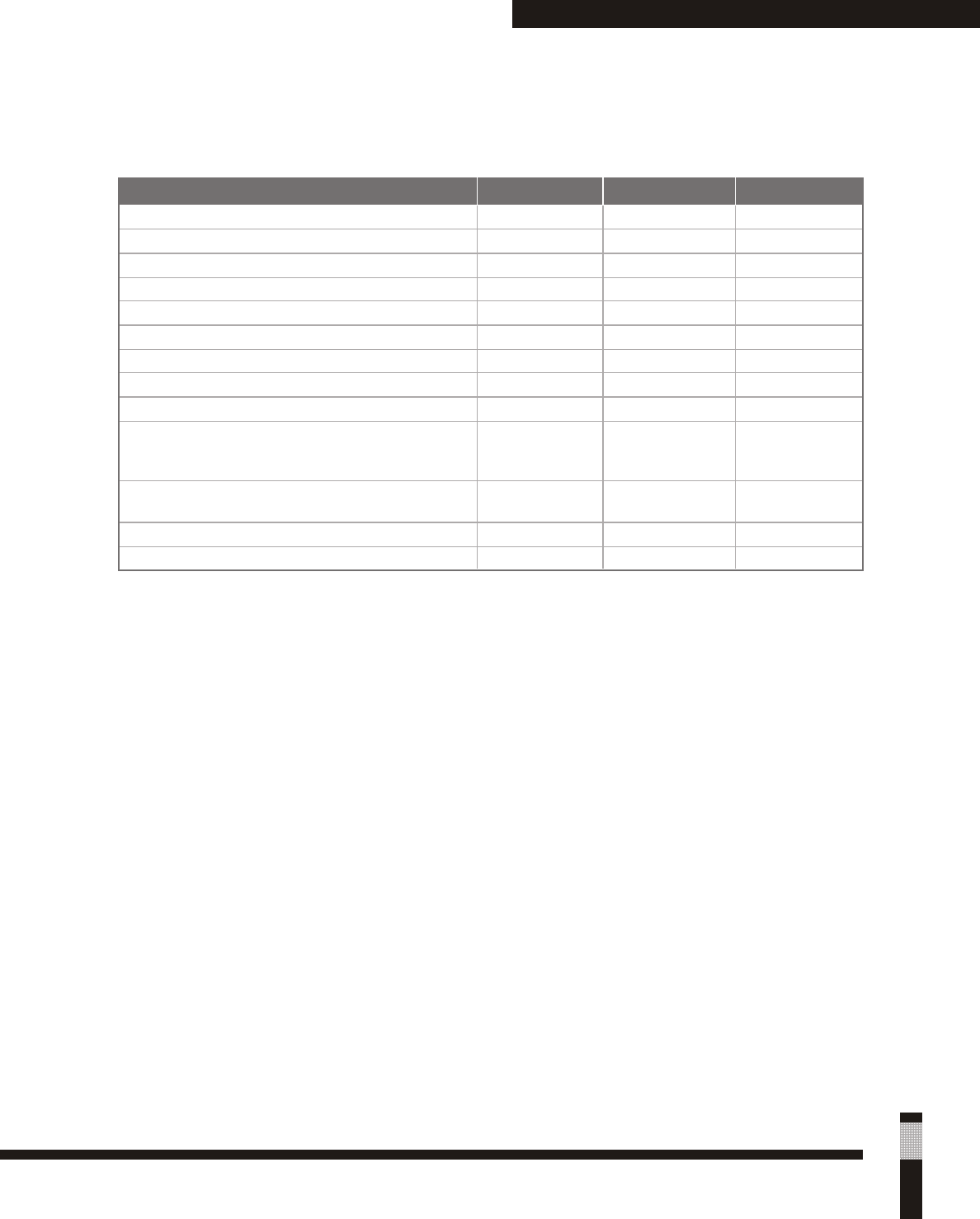

Non-interest expense

The following table sets forth, for the periods indicated, the principal components of non-interest expense.

(1) All amounts have been rounded off to the nearest Rs. 10.0 million.

Non-interest expense (excluding direct marketing agency expense and lease depreciation) increased by

25.9% for fiscal 2005 to Rs. 25.17 billion from Rs. 19.99 billion for fiscal 2004 primarily due to 35.0%

increase in employee expenses and 22.5% increase in other administrative expenses.

Employee expenses increased 35.0% to Rs. 7.37 billion in fiscal 2005 from Rs. 5.46 billion in fiscal 2004

primarily due to a 32.5% increase in the number of employees to 18,029 at March 31, 2005 from 13,609 at

March 31, 2004. The increase in number of employees was commensurate with the growth in ICICI Bank’s

retail operations.

Depreciation on own property increased by 12.3% to Rs. 2.93 billion from Rs. 2.61 billion primarily due to

additions to premises of Rs. 2.25 billion and other fixed assets of Rs. 2.83 billion during fiscal 2005.

Other operating expenses increased primarily due to the increased volume of business, particularly in

retail banking and includes maintenance of ATMs, credit card expenses, call centre expenses and

technology expenses. The volume of credit cards issued increased to about 3.3 million at March 31, 2005

from about 2.2 million at March 31, 2004. The number of branches and extension counters increased to

562 at March 31, 2005 from 469 at March 31, 2004. The new branches were largely set up in the last quarter

of the financial year and the full impact on operating expense will be reflected in fiscal 2006. ATMs

increased to 1,910 at March 31, 2005 from 1,790 at March 31, 2004.

47

Management’s Discussion & Analysis

Employee expenses

Depreciation

Rent, taxes & lighting

Printing & stationery

Postage & courier

Repairs & maintenance

Insurance

Bank charges

Others

Total non-interest expense (excluding

lease depreciation and direct marketing

agency expenses)

Depreciation (including lease equalization)

on leased assets

Direct marketing agency expenses

Total non-interest expense

% change

35.0

12.3

24.2

2.3

22.5

13.7

81.8

16.0

29.6

25.9

6.5

65.0

28.3

Fiscal 2005

7.37

2.93

1.85

0.88

1.74

2.16

0.60

0.29

7.35

25.17

2.97

4.85

32.99

Fiscal 2004

5.46

2.61

1.49

0.86

1.42

1.90

0.33

0.25

5.67

19.99

2.79

2.94

25.71

Rs. in billion, except percentages

Dickenson Tel: 022-2625 2282