ICICI Bank 2005 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

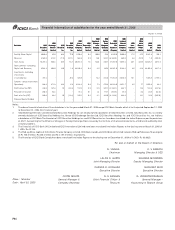

F69

Convenience

translation

into US$

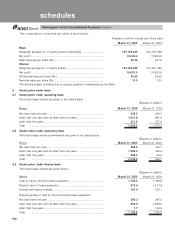

Rs. Rs. Rs. US$

Operating activities

Net income/(loss) ................................................................. (7,983) 5,219 8,530 196

Adjustments to reconcile net income to net cash

(used in)/provided by operating activities:

Provision for loan and other credit losses......................... 19,649 20,055 14,677 336

Depreciation ......................................................................... 2,438 2,791 3,560 82

Amortization of intangibles and deferred income............ 5,815 (1,902) (1,005) (23)

Amortization of discounts and expenses on borrowings 607 856 272 6

Deferred income tax............................................................ (4,348) (2,046) (1,766) (40)

Unrealized loss/(gain) on trading assets ............................ (1,126) (835) 1,840 42

Unrealized loss/(gain) on venture capital Investments .... 1,278 (499) (62) (1)

Other than temporary decline in value of other

securities .......................................................................... 2,098 944 663 15

Undistributed equity in (earning)/loss of affiliates ........... 958 1,631 577 13

Minority interest................................................................... (24) (28) (14)

(Gain)/loss on sale of property and equipment, net ......... (16) (345) (33) (1)

(Gain)/loss on sale of securities available for sale............ (956) (12,443) (5,863) (134)

Gain on sale of loans ........................................................... (2,795) (4,687) (5,414) (124)

Change in assets and liabilities

Trading account assets ................................................... 29,944 (34,686) (2,223) (51)

Interest and fees receivable........................................... (2,990) 5,943 (10,682) (245)

Other assets..................................................................... (34,295) (18,535) (30,616) (702)

Trading account liabilities ............................................... (13,656) (7) (1,821) (42)

Taxes payable................................................................... 5,830 3,300 (2,295) (53)

Other liabilities ................................................................ 4,663 18,750 55,849 1,280

Net cash (used in)/ provided by operating activities ... 5,091 (16,524) 24,174 554

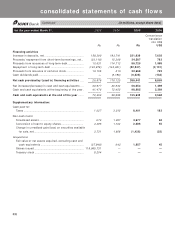

Investing activities

Purchase of available for sale securities ........................... (717,765) (270,405) (329,174) (7,546)

Purchase of venture capital investments .......................... (1,268) (3,097) (3,399) (78)

Purchase of non-readily marketable equity securities ..... (1,150) (561) (3,292) (75)

Proceeds from sale of available for sale securities.......... 684,769 255,316 261,110 5,986

Proceeds from sale of venture capital investments ........ 207 2,157 4,671 107

Proceeds from sale of non-readily marketable equity

securities .......................................................................... — 1,358 4,704 108

Origination of loans, net ...................................................... (108,023) (237,709) (497,107) (11,396)

Proceeds from sale of loans ............................................... 51,780 128,269 218,566 5,011

Purchase of property and equipment ................................ (6,943) (5,740) (6,664) (153)

Proceeds from sale of property and equipment ............... 504 1,305 265 6

Investments in affiliates...................................................... (1,691) (2,635) (1,684) (39)

Payment for business acquisition, net of cash acquired . 98,487 (1,322) (1,957) (45)

Net cash (used in)/ provided by investing activities .... (1,093) (133,064) (353,961) (8,114)

for the year ended March 31, 2003 2004 2005 2005

(in millions, except share data)

consolidated statements of cash flows