ICICI Bank 2005 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F14

forming part of the Accounts (Contd.)

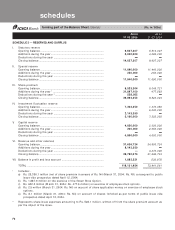

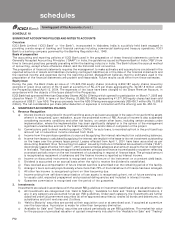

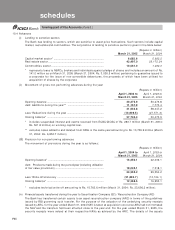

5. Fixed assets and depreciation

a) Premises and other fixed assets are carried at cost less accumulated depreciation. Depreciation is charged over

the estimated useful life of a fixed asset on a “straight line” basis. The rates of depreciation for fixed assets,

which are not lower than the rates prescribed in schedule XIV of the Companies Act, 1956, are as follows:

AssetAsset

AssetAsset

Asset Depreciation RateDepreciation Rate

Depreciation RateDepreciation Rate

Depreciation Rate

Premises owned by the Bank ................................................................................ 1.63%

Improvements to leasehold premises .................................................................. 1.63% or over the lease

period, whichever is higher

ATMs ......................................................................................................................... 12.50%

Plant and machinery like air conditioners, xerox machines, etc........................ 10%

Furniture and fixtures ............................................................................................. 15%

Motor vehicles......................................................................................................... 20%

Computers ............................................................................................................... 33.33%

EDC Terminals ......................................................................................................... 16.67%

Others (including software and system development expenses) ..................... 25%

b) Depreciation on leased assets is made on a straight-line basis at the higher of the rates determined with

reference to the primary period of lease and the rates specified in Schedule XIV to the Companies Act, 1956.

c) Assets purchased/sold during the year are depreciated on the basis of actual number of days the asset has been

put to use.

d) Items costing less than Rs. 5,000 are depreciated fully over a period of 12 months from the date of purchase.

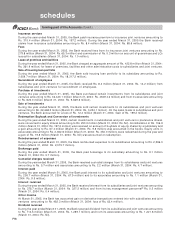

6. Foreign currency transactions

a) Foreign currency income and expenditure items of domestic operations are translated at the exchange rates

prevailing on the date of the transaction, income and expenditure items of integral foreign operations

(representative offices) are translated at weekly average closing rate, and income and expenditure of non

integral foreign operations (foreign branches and off-shore banking units) are translated at quarterly average

closing rate.

b) Monetary foreign currency assets and liabilities of domestic and integral foreign operations are translated at

closing exchange rates notified by Foreign Exchange Dealers’ Association of India (“FEDAI”) at the balance

sheet date and the resulting profits/losses are included in the profit and loss account.

c) Both monetary and non-monetary foreign currency assets and liabilities of non integral foreign operations are

translated at closing exchange rates notified by FEDAI at the balance sheet date and the resulting profits/losses

exchange differences are accumulated in the foreign currency translation reserve until the disposal of the net

investment in the non integral foreign operations.

d) Outstanding forward exchange contracts are stated at contracted rates and are revalued at the exchange rates

notified by FEDAI for specified maturities and at interpolated rates for contracts of in-between maturities. The

resultant gains or losses are recognised in the profit and loss account.

e) Contingent liabilities on account of guarantees, endorsements and other obligations are stated at the exchange

rates notified by FEDAI at the balance sheet date.

7. Accounting for Derivative Contracts

The Bank enters into derivative contracts such as foreign currency options, interest rate and currency swaps and cross

currency interest rate swaps to hedge on-balance sheet/off-balance sheet assets and liabilities or for trading purposes.

The swap contracts entered to hedge on-balance sheet assets and liabilities are structured in such a way that they

bear an opposite and offsetting impact with the underlying on-balance sheet items. The impact of such derivative

instruments is correlated with the movement of underlying assets and accounted pursuant to the principles of

hedge accounting.

Foreign currency and rupee derivatives, which are entered for trading purposes, are marked to market and the

resulting gain/loss, (net of provisions, if any) is recorded in the profit and loss account.

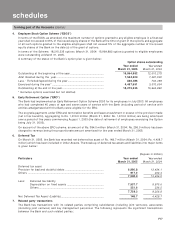

8. Employee Stock Option Scheme (“ESOS”)

The Bank has formulated an Employees Stock Option Scheme. The Scheme provides that employees are granted an

option to acquire equity shares of the Bank that vests in graded manner. The options may be exercised within a

specified period. The Bank follows the intrinsic value method for computing the compensation cost, if any, for all

options granted.

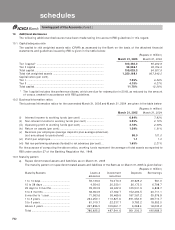

9. Staff Retirement Benefits

For employees covered under group gratuity scheme of Life Insurance Corporation of India (“LIC”)/ICICI Prudential

Life Insurance Company Limited (“ICICI Prulife”), gratuity charge to profit and loss account is on the basis of premium

charged. For employees covered under group superannuation scheme of LIC, the superannuation charged to profit

and loss account is on the basis of premium charged by LIC. Provision for gratuity for other employees and leave

schedules