ICICI Bank 2005 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F24

schedules

forming part of the Accounts (Contd.)

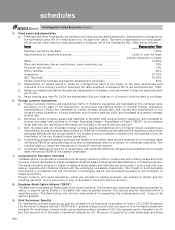

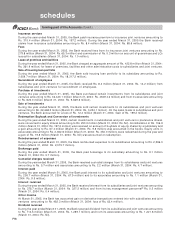

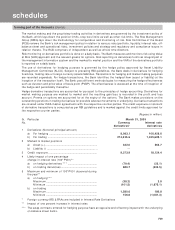

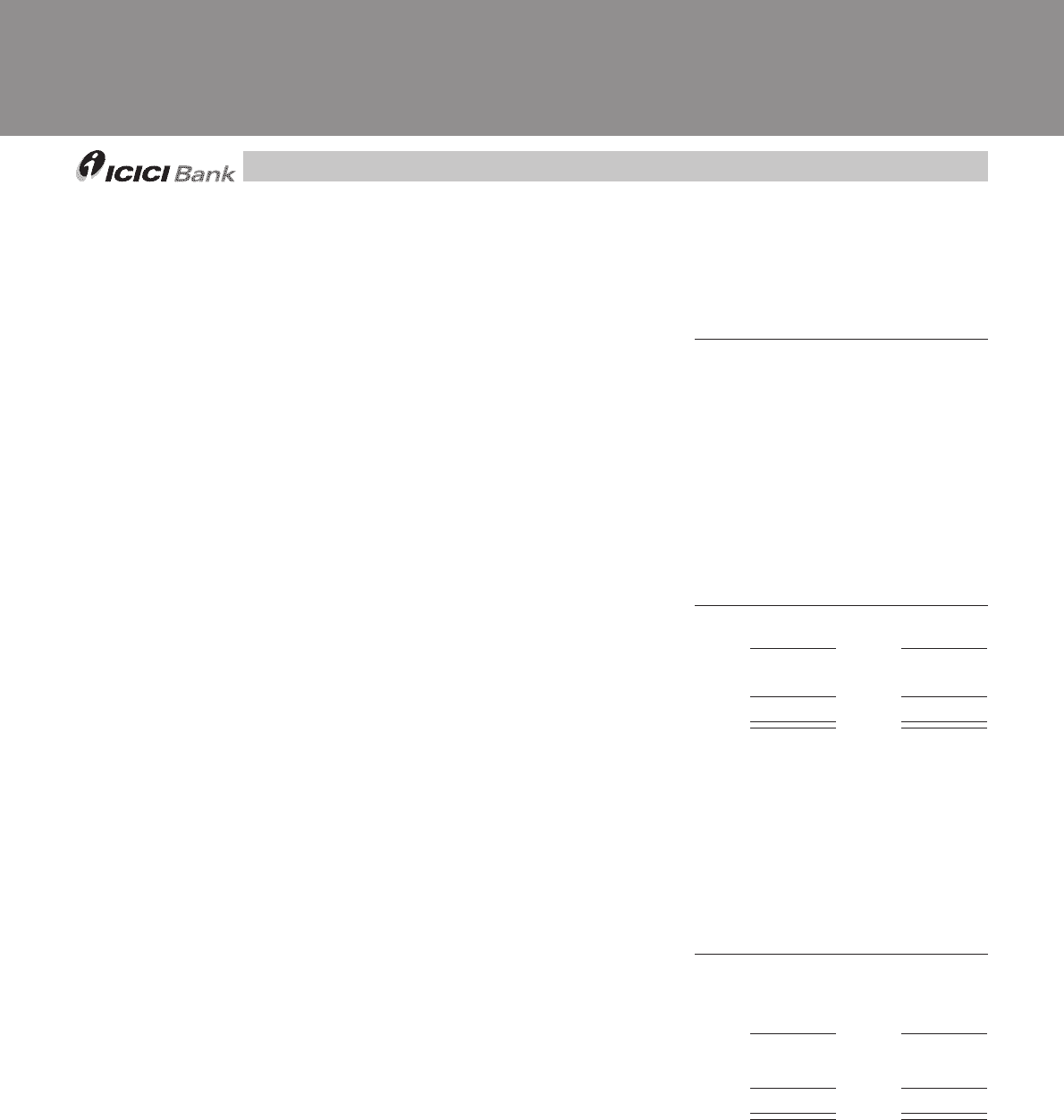

10.4 Advances

(i) Lending to sensitive sectors

The Bank has lending to sectors, which are sensitive to asset price fluctuations. Such sectors include capital

market, real estate and commodities. The net position of lending to sensitive sectors is given in the table below:

(Rupees in million)

March 31, 2005 March 31, 2004

Capital market sector* .................................................................... 6,683.6 5,932.2

Real estate sector ........................................................................... 43,497.0 25,172.34

Commodities sector ....................................................................... 10,061.0 1,032.0

* represents loans to NBFCs, brokers and individuals against pledge of shares and includes an amount of Rs.

141.0 million as on March 31, 2005 (March 31, 2004: Rs. 3,026.5 million) pertaining to guarantee issued to

a corporate for the issue of non-convertible debentures, the proceeds of which have been utilised for

acquisition of shares by the corporate

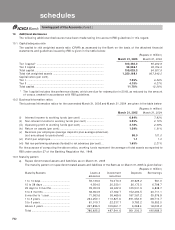

(ii) Movement of gross non-performing advances during the year

(Rupees in million)

April 1, 2004 to April 1, 2003 to

March 31, 2005 March 31, 2004

Opening balance ............................................................................. 30,475.9 50,273.8

Add: Additions during the year** ................................................. 11,157.9 7,773.4

41,633.8 58,047.2

Less: Reductions during the year .................................................. (13,929.5) (27,571.3)

Closing balance* ............................................................................. 27,704.3 30,475.9

* includes suspended interest and claims received from ECGC/DICGC of Rs. 283.7 million (March 31, 2004:

Rs. 501.8 million) on working capital loan.

** excludes cases added to and deleted from NPAs in the same year amounting to Rs. 13,759.9 million (March

31, 2004: Rs. 6,853.7 million)

(iii) Provision for non-performing advances

The movement of provisions during the year is as follows:

(Rupees in million)

April 1, 2004 to April 1, 2003 to

March 31, 2005 March 31, 2004

Opening balance* ........................................................................... 16,250.1 22,036.1

Add: Provisions made during the period/year (including utilisation

of fair value provisions) .................................................................. 18,002.1 7,318.1

34,252.2 29,354.2

Less: Write-offs/recovery ............................................................... (21,883.7) (13,104.1)

Closing balance* ............................................................................. 12,368.5 16,250.1

* excludes technical write-off amounting to Rs. 15,763.6 million (March 31, 2004: Rs. 23,696.2 million).

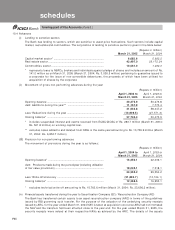

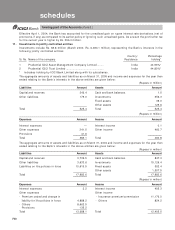

(iv) Financial assets transferred during the year to Securitisation Company (SC) / Reconstruction Company (RC)

The Bank has transferred certain assets to an asset reconstruction company (ARC) in terms of the guidelines

issued by RBI governing such transfer. For the purpose of the valuation of the underlying security receipts

issued by ARC, for the year ended March 31, 2004 NAV is taken at acquisition cost since ARC had not intimated

the NAV and the transfers had been effected close to the year end. For the year ended March 31, 2005, the

security receipts were valued at their respective NAVs as advised by the ARC. The details of the assets