ICICI Bank 2005 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F29

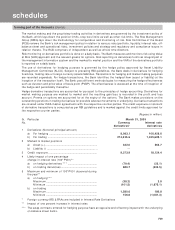

The market making and the proprietary trading activities in derivatives are governed by the investment policy of

the Bank, which lays down the position limits, stop loss limits as well as other risk limits. The Risk Management

Group (RMG) lays down the methodology for computation and monitoring of risk. Risk Committee of the Board

(RCB) reviews the Bank’s risk management policy in relation to various risks (portfolio, liquidity, interest rate, off-

balance sheet and operational risks), investment policies and strategy and regulatory and compliance issues in

relation thereto. The RCB comprises of independent as well as whole time directors.

Risk monitoring on derivatives portfolio is done on a daily basis. The Bank measures and monitors risk using Value

at Risk (VAR) approach and the relevant greeks for options. Risk reporting on derivatives forms an integral part of

the management information system and the marked to market position and the VAR of the derivatives portfolio

is reported on a daily basis.

The use of derivatives for hedging purpose is governed by the hedge policy approved by Asset Liability

Management Committee (ALCO). Subject to prevailing RBI guidelines, the Bank deals in derivatives for hedging

fixed rate, floating rate or foreign currency assets/liabilities. Transactions for hedging and market making purposes

are recorded separately. For hedge transactions, the Bank identifies the hedged item (asset or liability) at the

inception of the transaction itself. The Bank uses different methodologies for measuring the hedge effectiveness

such as duration and price value of basis point (PVBP). The effectiveness is assessed at the time of inception of

the hedge and periodically thereafter.

Hedge derivative transactions are accounted for pursuant to the principles of hedge accounting. Derivatives for

market making purpose are marked to market and the resulting gain/loss is recorded in the profit and loss

account. Premia on options are accounted for at the expiry of the options. The Bank makes provisions on the

outstanding positions in trading derivatives for possible adverse movements in underlying. Derivative transactions

are covered under ISDA master agreements with the respective counter parties. The credit exposure on account

of derivative transactions is computed as per RBI guidelines and is marked against the credit limits approved for

the respective counter parties.

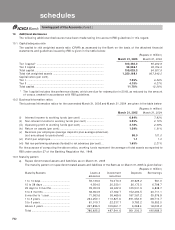

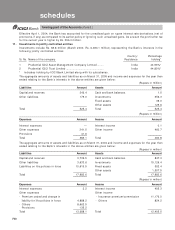

(Rupees in million)

Sr. Particular March 31, 2005

No. Currency Interest rate

derivatives* derivatives

1 Derivatives (Notional principal amount)

a) For hedging ................................................................. 8,083.1 106,428.6

b) For trading ................................................................... 274,325.6 1,335,689.1

2 Marked to market positions

a) Asset (+ )...................................................................... 442.0 564.7

b) Liability (-) .................................................................. .. —

3 Credit exposure .................................................................. 9,373.9 18,124.4

4 Likely impact of one percentage

change in interest rate (100*PV01)**

a) on hedging derivatives *** ........................................ (79.4) (22.1)

b) on trading derivatives................................................. 880.7 (534.5)

5 Maximum and minimum of 100*PV01 observed during

the year**

a) on hedging***

Maximum ..................................................................... (38.2) 2.8

Minimum ..................................................................... (101.5) (1,675.1)

b) on trading

Maximum ..................................................................... 1,280.6 180.8

Minimum ..................................................................... 156.6 (1,081.3)

* Foreign currency IRS & FRAs are included in Interest Rate Derivatives

** Impact of one percent increase in interest rates

*** The swap contracts entered for hedging purpose have an opposite and offsetting impact with the underlying

on-balance sheet items.

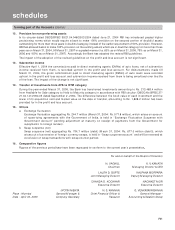

forming part of the Accounts (Contd.)

schedules