ICICI Bank 2005 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

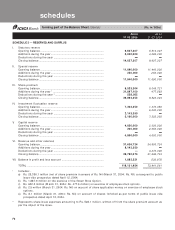

F16

forming part of the Accounts (Contd.)

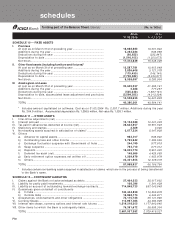

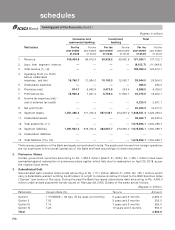

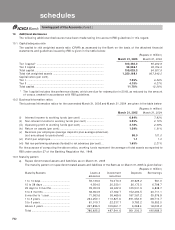

(Rupees in million)

Consumer and Investment Total

commercial banking banking

Particulars For the For the For the For the For the For the

year ended year ended year ended year ended year ended year ended

31.03.05 31.03.04 31.03.05 31.03.04 31.03.05 31.03.04

1. Revenue 106,436.9 95,819.3 30,926.2 35,902.8 137,363.1 131,722.1

2. Less: Inter segment revenue ————(9,102.7) (11,049.0)

3. Total revenue (1) –(2) ————128,260.4 120,673.1

4. Operating Profit (i.e. Profit

before unallocated

expenses, and tax) 19,760.7 12,984.2 10,183.3 12,080.1 29,944.0 25,064.3

5. Unallocated expenses ————384.0 256.0

6. Provisions (net) 814.1 5,542.8 3,473.9 243.4 4,288.0 5,786.2

7. Profit before tax 18,946.6 7,441.4 6,709.4 11,836.7 25,272.0 19,022.1

8. Income tax expenses (net) /

(net of deferred tax credit) ————5,220.0 2,651.1

9. Net profit(7)-(8) ————20,052.0 16,371.0

10. Segment assets 1,051,486.3 771,726.4 597,045.1 454,527.0 1,648,531.4 1,226,253.4

11. Unallocated assets ————28,062.7 26,035.3

12. Total assets(10)+ (11) ————1,676,594.1 1,252,288.7

13. Segment liabilities 1,291,932.4 978,706.4 384,661.7 273,582.3 1,676,594.1 1,252,288.7

14. Unallocated liabilities ——————

15. Total liabilities (13)+ (14) ————1,676,594.1 1,252,288.7

The business operations of the Bank are largely concentrated in India. The assets and income from foreign operations

are not significant to the overall operations of the Bank and have accordingly not been disclosed.

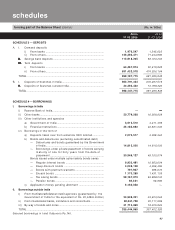

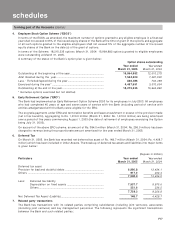

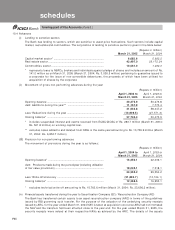

2. Preference Shares

Certain government securities amounting to Rs. 1,952.3 million (March 31, 2004: Rs. 1,455.1 million) have been

earmarked against redemption of preference share capital, which falls due for redemption on April 20, 2018, as per

the original issue terms.

3. Subordinated Debt

Subordinated debt includes index bonds amounting to Rs. 117.1 million (March 31, 2004: Rs. 105.1 million) which

carry a detachable warrant entitling bondholders to a right to receive an amount linked to the BSE Sensitive Index

(“Sensex”) per terms of the issue. During the year the Bank has raised subordinate debt amounting to Rs. 4,500.0

million under private placement bonds issued on February 28, 2005. Details of the same are as follows:

(Rupees in million)

Particulars Coupon Rate (%) Tenure Amount

Option I 1 Yr INBMK + 60 bps (To be reset six monthly) 5 years and 3 months 2,650.0

Option II 7.00 5 years and 3 months 350.0

Option III 7.10 7 years and 3 months 550.0

Option IV 7.20 10 years and 3 months 950.0

Total 4,500.0

schedules