ICICI Bank 2005 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F54

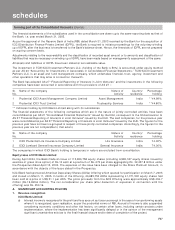

Other entities

In case of ICICI Securities Limited and ICICI Brokerage Services Limited,

1. All open positions are marked to market.

2. Gains are recognised only on settlement / expiry of the derivative instruments except for Interest Rate derivatives

where even mark-to-market gains are recognised.

3. Debit/ credit balance on open position are disclosed as current assets / current liabilities, as the case may be.

In case of ICICI Bank UK Limited, trading book derivatives are carried at fair value in the balance sheet within other

assets and other liabilities. Positive and negative fair values of trading derivatives are offset where contracts have

been entered into under master netting agreements or other arrangements that represents legally enforceable

right of set-off which will survive the liquidation of either party. Gains and losses are taken directly to the profit and

loss account and reported within Foreign exchange dealing profits. The income and expense arising from off -

balance sheet financial derivatives entered into for hedging purposes is recognised in the accounts in accordance

with the accounting treatment of the underlying transactions or transactions being hedged. All off- balance sheet

financial derivatives are held for the period in which the underlying hedge matures.

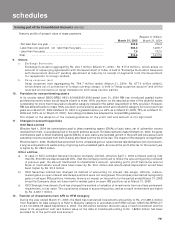

8. Employee stock option scheme ("ESOS")

The Bank has formulated an employees stock option scheme. The Scheme provides that employees are granted an

option to acquire equity shares of the Bank that vests in graded manner. The options may be exercised within a

specified period. The Bank follows the intrinsic value method for computing the compensation cost, if any, for all

options granted.

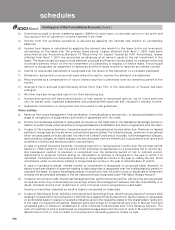

9. Staff retirement benefits

ICICI Bank Ltd.

For employees covered under group gratuity scheme of Life Insurance Corporation of India ("LIC")/ICICI Prudential

Life Insurance Company Limited ("ICICI Prulife"), gratuity charge to profit and loss account is on the basis of

premium charged. For employees covered under group superannuation scheme of LIC, the superannuation charged

to profit and loss account is on the basis of premium charged by LIC. Provision for gratuity for other employees

and leave encashment liability are determined as per actuarial valuation at year-end. Defined contributions for

provident fund are charged to the profit and loss account based on contributions made in terms of the scheme.

The Bank provides for pension, a deferred retirement plan, covering certain employees. The plan provides for a

pension payment on a monthly basis to these employees on their retirement based on the respective employee's

salary and years of employment with the Bank. Employees covered by the pension plan are not eligible for benefits

under the provident fund plan, a defined contribution plan. The pension plan is funded through periodic contributions

to a fund set-up by the Bank and administered by a Board of Trustees. Such contributions are actuarially determined.

Other entities

In case of ICICI Bank UK Limited, contributions to the pension scheme are charged to the profit and loss account

when paid.

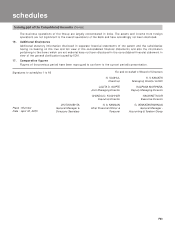

10. Income taxes

Income tax expense is the aggregate amount of current tax and deferred tax charge. Current year taxes are determined

in accordance with the Income Tax Act, 1961. Deferred tax adjustments comprise of changes in the deferred tax

assets or liabilities during the period.

Deferred tax assets and liabilities are recognised for the future tax consequences of timing differences arising

between the carrying values of assets and liabilities and their respective tax basis and operating carry forward

losses. Deferred tax assets are recognised only after giving due consideration to prudence. Deferred tax assets and

liabilities are measured using tax rates and tax laws that have been enacted or substantially enacted by the balance

sheet date. The impact on account of changes in the deferred tax assets and liabilities is also recognised in the profit

and loss account.

Deferred tax assets are recognised and reassessed at each reporting date, based upon management's judgement

as to whether realisation is considered reasonably certain. Deferred tax assets are recognised on carry forward of

unabsorbed depreciation and tax losses only if there is virtual certainty that such deferred tax asset can be realised

against future profits.

11. Impairment of assets

The carrying amounts of assets are reviewed at each balance sheet date if there is any indication of impairment based on

internal/external factors. An impairment loss is recognised wherever the carrying amount of an asset exceeds its recoverable

amount. The recoverable amount is the greater of the assets net selling price and value in use. In assessing value in use, the

estimated future cash flows are discounted to their present value at the weighted average cost of capital.

schedules

forming part of the Consolidated Accounts (Contd.)