ICICI Bank 2005 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F17

forming part of the Accounts (Contd.)

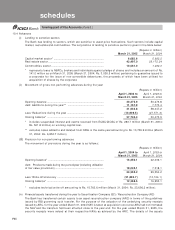

4. Employee Stock Option Scheme (“ESOS”)

In terms of the ESOS, as amended, the maximum number of options granted to any eligible employee in a financial

year shall not exceed 0.05% of the issued equity shares of the Bank at the time of grant of the options and aggregate

of all such options granted to the eligible employees shall not exceed 5% of the aggregate number of the issued

equity shares of the Bank on the date (s) of the grant of options.

In terms of the Scheme, 18,215,335 options (March 31, 2004: 15,964,982 options) granted to eligible employees

were outstanding at March 31, 2005.

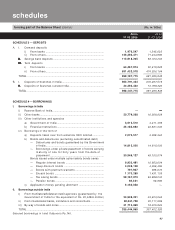

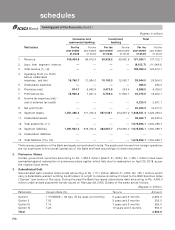

A summary of the status of the Bank’s option plan is given below: Option shares outsatanding

Year ended Year ended

March 31, 2005 March 31, 2004

Outstanding at the beginning of the year ............................................. 15,964,982 12,610,275

Add: Granted during the year ................................................................ 7,554,500 7,491,800

Less : Forfeited/lapsed during the year................................................. 846,496 766,489

Exercised during the year* ...................................................................... 4,457,651 3,370,604

Outstanding at the end of the year ........................................................ 18,215,335 15,964,982

* Excludes options exercised but not allotted.

5. Early Retirement Option (“ERO”)

The Bank had implemented an Early Retirement Option Scheme 2003 for its employees in July 2003. All employees

who had completed 40 years of age and seven years of service with the Bank (including period of service with

entities amalgamated with the Bank) were eligible for the ERO.

The ex-gratia payments under ERO and termination benefits and leave encashment in excess of the provision made

(net of tax benefits), aggregating to Rs. 1,910.0 million (March 31, 2004: Rs. 1,910.0 million) are being amortised

over a period of five years commencing August 1, 2003 (the date of retirement of employees exercising the Option

being July 31, 2003).

On account of the above ERO scheme, an amount of Rs. 384.0 million (March 31, 2004: Rs. 256.0 million) has been

charged to revenue being the proportionate amount amortised for the year ended March 31, 2005.

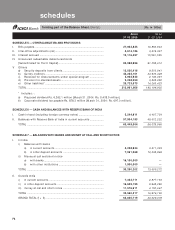

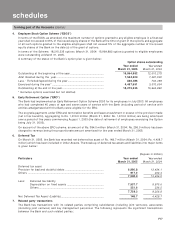

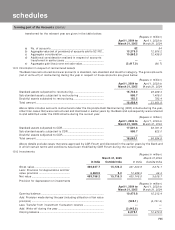

6. Deferred Tax

On March 31, 2005, the Bank has recorded net deferred tax asset of Rs. 148.7 million (March 31, 2004: Rs. 4,429.7

million) which has been included in Other Assets. The break-up of deferred tax assets and liabilities into major items

is given below:

(Rupees in million)

Particulars Year ended Year ended

March 31, 2005 March 31, 2004

Deferred tax asset

Provision for bad and doubtful debts .................................................... 6,990.8 13,434.1

Others ....................................................................................................... 917.2 202.4

7,908.0 13,636.5

Less: Deferred tax liability

Depreciation on fixed assets .................................................. 7,537.7 8,970.6

Others........................................................................................ 221.6 236.2

7,759.3 9,206.8

Net Deferred Tax Asset/ (Liability).......................................................... 148.7 4,429.7

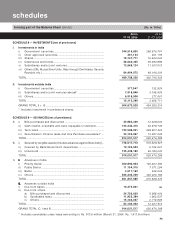

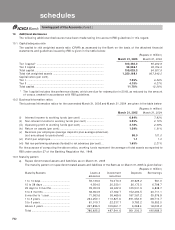

7. Related party transactions

The Bank has transactions with its related parties comprising subsidiaries (including joint ventures), associates

(including joint ventures) and key management personnel. The following represents the significant transactions

between the Bank and such related parties:

schedules