ICICI Bank 2005 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

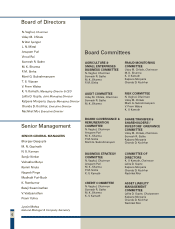

N. VAGHUL

Chairman

based products and services. They also started

delivering their products and services through

new channels like ATMs and the internet. New

players in the insurance and asset management

sectors also catalysed innovation in these

sectors, with a customer-friendly approach and a

wider array of choices for the customer on what

products and services they could have and the

channels they could use to access the provider.

This was backed by the simultaneous

development of a regulatory framework

covering all areas of the financial sector.

Prudential norms were introduced to improve

the quality of financial reporting and

capitalisation levels in the banking system.

Separate regulators were set up for the capital

markets and the insurance sector, to oversee

their orderly functioning within the liberalised

regime. The approach has been one of

combining dynamism with conservativism to

ensure healthy growth of the financial sector.

While there is a view that a gradualist approach

has slowed down the growth process relative to

other nations, this must be viewed in the context

of the health and resilience of the financial sector

despite the restructuring of the economy over

the past decade. While the scale of financial

intermediation in India must certainly increase,

we have been successful in creating an efficient

growth paradigm based on market forces

combined with high standards of regulation and

governance.

As we go forward, the financial sector has a

critical role to play in the full realisation of India's

potential. At the core of this is the need to vastly

increase the access to financial services in the

rural areas, particularly among lower-income

groups, as well as the poor in the urban areas.

This will bring people into the economic

mainstream, tap their productivity and result in

larger and larger sections of our people

contributing to India’s growth as well as

benefiting from it. We must leverage all our

3

Message from the Chairman

existing skills - financial and technological - and

acquire the new capabilities necessary to make

this happen, partnering with government and

other financial, industrial and social

organisations to bring about widespread change

and prosperity.

At the ICICI group we see ourselves as a strong

and effective player in the financial system. We

have evolved and grown and changed with India

over the last five decades. We provide the full

range of financial services to corporate and retail

customers and are rapidly expanding our scale

of operations. Our strategy is to continue to

grow our existing businesses and create a

robust business model for rural India and the

urban low-income segment, play a serious and

proactive role in India’s growth and

devel opment and establ ish a meaningful

presence in target markets overseas. We believe

that given our innate strengths, we can realise

this vision.

Dickenson Tel: 022-2625 2282