ICICI Bank 2005 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

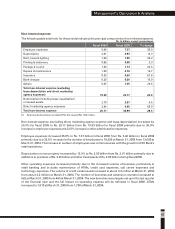

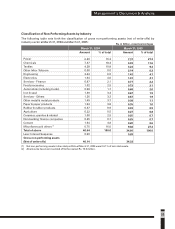

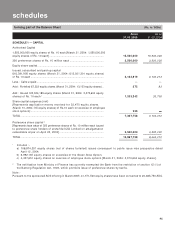

Classification of loan assets

All loans are classified as per RBI guidelines into performing and non-performing loans. Under these

guidelines, effective year-end fiscal 2004, a term loan is classified as non-performing if any amount of

interest or principal remains overdue for more than 90 days (as against the period of 180 days stipulated

earlier). Similarly, an overdraft or cash credit facility is classified as non-performing if the account remains

out of order for a period of 90 days and a bill is classified as non-performing if the account remains overdue

for more than 90 days. Further, non-performing assets are classified into sub-standard, doubtful and loss

assets.

The Bank does not distinguish between provisions and write-offs while assessing the adequacy of the

Bank’s loan loss coverage, as both provisions and write-offs represent a reduction of the principal amount

of a non-performing asset. In compliance with regulations governing the presentation of financial

information by banks, the Bank reports non-performing assets net of cumulative write-offs in its financial

statements.

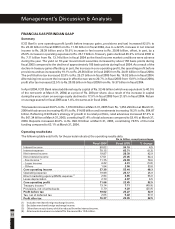

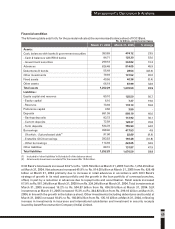

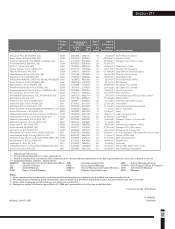

The following table sets forth classification of net customer assets (net of write-offs and provisions) of ICICI

Bank at March 31, 2004 and at March 31, 2005.

(1) All loss assets have been written off or provided for.

(2) All amounts have been rounded off to the nearest Rs. 10.0 million.

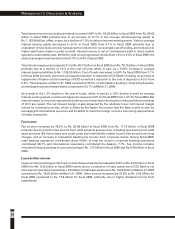

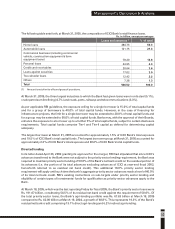

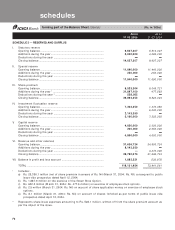

The following table sets forth, for the dates indicated, data regarding the non-performing assets.

(1) Net of write-offs, interest suspense and claims received from ECGC/ DICGC.

(2) All amounts have been rounded off to the nearest Rs. 10.0 million.

The ratio of net non-performing assets to net customer assets decreased to 2.0% at March 31, 2005 from

2.9% at March 31, 2004. At March 31, 2005, the gross non-performing assets (net of write-offs) were

Rs. 34.32 billion compared to Rs. 40.14 billion at March 31, 2004. Including technical write-offs, the gross

non-performing loans at March 31, 2005 were Rs. 51.40 billion compared to Rs. 67.15 billion at March 31,

2004. The coverage ratio (i.e. total provisions and write-offs against non-performing assets as a

percentage of gross non-performing assets) at March 31, 2005 was 61.4%. The Bank’s investments in

security receipts issued by Asset Reconstruction Company (India) Limited, a reconstruction company

registered with RBI, was Rs. 21.08 billion at March 31, 2005.

Management’s Discussion & Analysis

Rs. billion

Standard assets

Of which: restructured standard assets

Non-performing assets

(1)

Of which: Loss assets

Doubtful assets

Sub-standard assets

Less: General provision on non-performing assets

Net customer assets

959.11

62.63

19.83

-

13.70

6.13

-

978.94

689.65

66.29

20.37

-

13.22

8.62

(1.47)

710.02

March 31, 2004 March 31, 2005

March 31, 2003

March 31, 2004

March 31, 2005

4.9

2.9

2.0

Rs. billion

58.39

40.14

34.32

(1)

Gross NPA

% of Net NPA to

net customer assets

31.51

20.37

19.83

Net NPA

640.51

710.02

978.94

Net customer

assets

Dickenson Tel: 022-2625 2282