ICICI Bank 2005 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

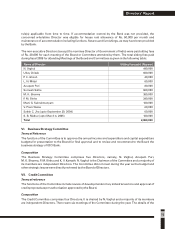

In May 2005, the Bank acquired the entire paid-up capital of Investitsionno-Kreditny Bank (IKB), a Russian

bank with its registered office in Balabanovo in the Kaluga region and a branch in Moscow. At March 31,

2005, IKB had total assets of about US$ 4.4 million. IKB became a subsidiary of the Bank effective May 19,

2005. The Bank and Prudential plc of UK have agreed that the Bank will acquire 6% of the paid-up equity

capital of Prudential ICICI Asset Management Company Limited and Prudential ICICI Trust Limited,

consequent to which these two companies will become subsidiaries of the Bank. On June 30, 2005, the

High Court of Judicature at Bombay approved the merger of ICICI Distribution Finance Private Limited with

ICICI Home Finance Company Limited.

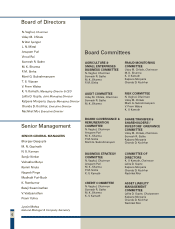

Satish C. Jha retired at the Annual General Meeting (AGM) held on September 20, 2004 and did not seek

re-appointment.

S. B. Mathur, Chairman of Life Insurance Corporation of India (LIC) resigned from the Board effective

March 4, 2005 consequent to his retirement from LIC and P. C. Ghosh, Chairman, General Insurance

Corporation of India (GIC) resigned from the Board effective May 6, 2005 consequent to his retirement

from GIC.

The Board at its Meeting held on April 30, 2005 appointed T.S. Vijayan, Managing Director, LIC and Sridar

Iyengar, a chartered accountant and former partner with KPMG, as additional Directors of the Bank. They

would hold office up to the date of the forthcoming AGM but are eligible for appointment.

N. Vaghul was appointed as a Director of the Bank on March 27, 2002. He was appointed as non-executive

Chairman of the Board effective May 3, 2002 for a period of three years, as stipulated by Reserve Bank of

India (RBI) while approving his appointment as Chairman of the Board. The Board at its Meeting held on

April 30, 2005, reappointed him as Chairman of the Board subject to the approval of RBI, which has since

been received.

The Board has approved the following with respect to the wholetime Directors of the Bank:

!Re-appointment of K. V. Kamath, Managing Director & CEO, on the expiry of his current term i.e. from

May 1, 2006, till April 30, 2009.

!Re-appointment of Kalpana Morparia, Deputy Managing Director, on the expiry of her current term i.e.

from May 1, 2006, till May 31, 2007, when she attains retirement age.

!Re-appointment of Chanda Kochhar and Nachiket Mor, Executive Directors, on the expiry of their

current terms i.e. from April 1, 2006, till March 31, 2011.

The above appointments of wholetime directors are subject to the approval of the members and RBI.

DIRECTORS

“We have a strong focus on communicating with our

investors to explain our strategy and performance

and understand their perspectives. Our ability to

raise capital and the confidence that our investors

have placed in us over the years have been critical to

our growth and new business initiatives. ”

Kalpana Morparia

Deputy Managing Director

11

Directors’ Report

Dickenson Tel: 022-2625 2282