ICICI Bank 2005 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

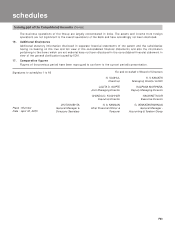

F66

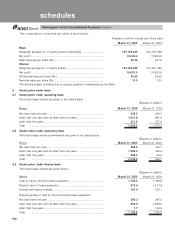

(in millions, except share data)

Convenience

translation

into US$

Rs. Rs. US$

Assets

Cash and cash equivalents ........................................................... 98,985 155,639 3,568

Trading assets ................................................................................ 75,155 75,538 1,732

Securities:

Available for sale .................................................................... 296,605 369,818 8,478

Non-readily marketable equity securities............................ 8,621 7,209 165

Venture capital investments ................................................. 5,142 3,932 90

Investments in affiliates................................................................ 3,619 4,725 108

Loans, net of allowance for loan losses, security deposits

and unearned income.................................................................... 728,520 999,858 22,922

Customers’ liability on acceptances ............................................ 65,142 74,116 1,699

Property and equipment, net........................................................ 23,183 26,055 597

Assets held for sale ....................................................................... 4,829 3,741 86

Goodwill .......................................................................................... 5,403 7,407 170

Intangible assets, net .................................................................... 4,513 4,199 96

Deferred tax assets ....................................................................... 7,937 12,111 278

Interest and fees receivable ......................................................... 6,529 17,211 395

Other assets ................................................................................... 74,948 101,888 2,336

Total assets ................................................................................... 1,409,131 1,863,447 42,720

Liabilities

Interest bearing deposits .............................................................. 611,178 889,626 20,395

Non-interest bearing deposits ...................................................... 73,777 126,908 2,909

Trading liabilities ............................................................................ 26,079 24,258 556

Short-term borrowings .................................................................. 57,364 91,951 2,108

Bank acceptances outstanding..................................................... 65,142 74,116 1,699

Long-term debt .............................................................................. 373,449 367,499 8,425

Redeemable preferred stock ........................................................ 944 1,044 24

Taxes and dividends payable ........................................................ 20,180 17,885 410

Deferred tax liabilities ................................................................... 614 550 13

Other liabilities ............................................................................... 84,829 139,546 3,199

Total liabilities .............................................................................. 1,313,556 1,733,383 39,738

Commitments and contingencies

Minority interest .......................................................................... 1,050 2,068 47

Stockholders’ equity:

Common stock at Rs. 10 par value: 800,000,000 and

1,550,000,000 shares authorized as of March 31, 2004

and 2005; Issued and outstanding 616,391,905 and

736,738,564 shares as of March 31, 2004 and 2005,

respectively .................................................................................... 6,164 7,368 169

Additional paid-in capital ............................................................... 65,341 96,818 2,220

Retained earnings .......................................................................... 18,279 20,581 472

Deferred compensation costs ...................................................... —(60) (1)

Accumulated other comprehensive income............................... 4,741 3,289 75

Total stockholders’ equity .......................................................... 94,525 127,996 2,935

Total liabilities and stockholders’ equity ............................................................

............................................................

.............................. 1,409,131 1,863,447 42,720

consolidated balance sheets

at March 31, 2004 2005 2005