ICICI Bank 2005 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

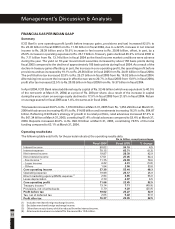

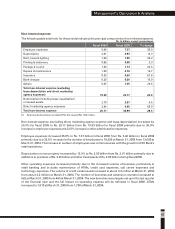

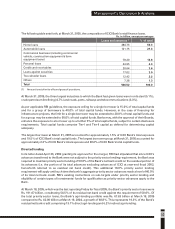

Financial condition

The following table sets forth, for the periods indicated, the summarised balance sheet of ICICI Bank.

(1) Included in ‘other liabilities’ in Schedule 5 of the balance sheet.

(2) All amounts have been rounded off to the nearest Rs. 10.0 million.

ICICI Bank’s total assets increased 33.9% to Rs. 1,676.59 billion at March 31, 2005 from Rs. 1,252.29 billion

at March 31, 2004. Net advances increased 45.9% to Rs. 914.05 billion at March 31, 2005 from Rs. 626.48

billion at March 31, 2004 primarily due to increase in retail advances in accordance with ICICI Bank’s

strategy of growth in its retail asset portfolio and the growth in the loan portfolio of overseas branches,

offset, in part by a reduction in advances due to repayments and securitisation. Retail assets increased

67.9% to Rs. 561.34 billion at March 31, 2005 from Rs. 334.24 billion at March 31, 2004. Total investments at

March 31, 2005 increased 16.2% to Rs. 504.87 billion from Rs. 434.36 billion at March 31, 2004. SLR

investments at March 31, 2005 increased 15.3% to Rs. 344.82 billion from Rs. 299.18 billion at March 31,

2004, in line with the growth in the balance sheet. Other investments (including debentures and bonds) at

March 31, 2005 increased 18.4% to Rs. 160.06 billion from Rs. 135.18 billion at March 31, 2004, reflecting

increase in investments in insurance and international subsidiaries and investment in security receipts

issued by Asset Reconstruction Company (India) Limited.

49

Management’s Discussion & Analysis

Assets:

Cash, balances with banks & government securities

- Cash & balances with RBI & banks

- Government securities

Advances

Debentures & bonds

Other investments

Fixed assets

Other assets

Total assets

Liabilities :

Equity capital and reserves

- Equity capital

- Reserves

Preference capital

Deposits

- Savings deposits

- Current deposits

- Term deposits

Borrowings

(1)

Of which : Subordinated debt

- Erstwhile ICICI borrowings

- Other borrowings

Other liabilities

Total liabilities

% change

23.5

52.6

15.3

45.9

(48.6)

65.0

(0.4)

32.9

33.9

56.7

19.6

59.8

-

46.6

36.1

76.8

44.0

4.8

(9.9)

(31.8)

94.9

47.9

33.9

March 31, 2005

474.12

129.30

344.82

914.05

28.54

131.52

40.38

87.99

1,676.59

125.50

7.37

118.13

3.50

998.19

113.92

128.37

755.90

417.53

82.09

193.48

224.05

131.87

1,676.59

March 31, 2004

Rs. in billion, except percentages

383.89

84.71

299.18

626.48

55.49

79.69

40.56

66.19

1,252.29

80.10

6.16

73.94

3.50

681.09

83.72

72.59

524.78

398.46

91.06

283.52

114.94

89.15

1,252.29

Dickenson Tel: 022-2625 2282