ICICI Bank 2005 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

Business Overview

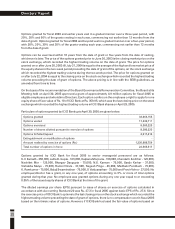

CREDIT RATINGS

ICICI Bank’s credit ratings by various credit rating agencies are given below:

RISK MANAGEMENT

Risk is an integral part of the banking business and we aim at the delivery of superior shareholder value by

achieving an appropriate trade-off between risk and returns. We are exposed to various risks, including

credit risk, market risk and operational risk. Our risk management strategy is based on a clear

understanding of various risks, disciplined risk assessment and measurement procedures and continuous

monitoring. The policies and procedures established for this purpose are continuously benchmarked with

international best practices. The risk management function is supported by a comprehensive range of

quantitative and modeling tools developed by a dedicated risk analytics team.

We have two dedicated groups, the Risk Management Group (RMG) and the Compliance & Audit Group

(CAG) which are responsible for assessment, management and mitigation of risk in ICICI Bank. These

groups form part of the Corporate Centre, are completely independent of all business operations and are

accountable to the Risk and Audit Committees of the Board of Directors. RMG is further organised into

Credit Risk Management Group, Market Risk Management Group, Retail Risk Management Group and Risk

Analytics Group. CAG is further organised into the Compliance & Anti-Money Laundering Group and the

Internal Audit Group.

Credit Risk

Credit risk is the risk that a borrower is unable to meet its financial obligations to the lender. We measure,

monitor and manage credit risk for each corporate borrower and also at the portfolio level. We have

standardised credit approval processes, which include a well-established procedure of comprehensive

credit appraisal and rating. We have developed internal credit rating methodologies for rating obligors as

well as for products/ facilities. The rating factors in quantitative, qualitative issues and credit enhancement

features specific to the transaction. The rating serves as a key input in the approval as well as post-approval

credit processes. Credit rating, as a concept, has been well internalised within the Bank. The rating for

every corporate borrower is reviewed at least annually and for higher risk credits and large exposures on a

more regular basis. Industry knowledge is constantly updated through field visits, interactions with clients,

regulatory bodies and industry experts.

In our retail credit operations, all products, policies and authorisations are approved by the Board or a

Board Committee. Credit approval authority lies only with our credit officers who are distinct from the sales

teams. Our credit officers evaluate credit proposals on the basis of the approved product policy and risk

assessment criteria. Credit scoring models are used in the case of certain products like credit cards,

External agencies such as field investigation agencies and credit processing agencies are used to facilitate

a comprehensive due diligence process including visits to offices and homes in the case of loans to

individual borrowers. Before disbursements are made, the credit officer conducts a centralised check on

the delinquencies database and review of the borrower’s profile. We continuously refine our retail credit

parameters based on portfolio analytics.

Rating

Moody’s Investor Service (Moody’s)

Standard & Poor’s (S&P)

Credit Analysis & Research Limited (CARE)

Investment Information and Credit Rating Agency (ICRA)

Agency

Baa3

BB+

CARE AAA

AAA

Dickenson Tel: 022-2625 2282