ICICI Bank 2005 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

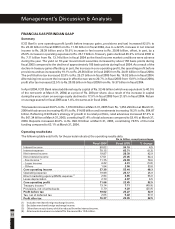

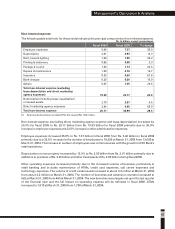

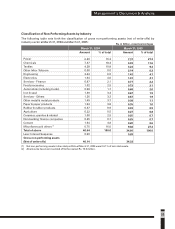

The following table sets forth, for the periods indicated, the profit/(loss) of the principal subsidiaries of ICICI

Bank.

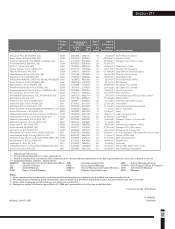

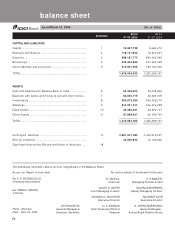

RECONCILIATION OF PROFITS AS PER INDIAN GAAP AND US GAAP

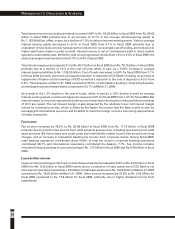

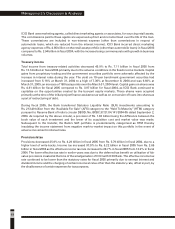

There are significant differences in the basis of accounting between US GAAP and Indian GAAP. In the

merger of ICICI with ICICI Bank, the Bank was the legal acquirer. Under Indian GAAP, the Bank is the

accounting acquirer. Under US GAAP, ICICI is deemed to have acquired ICICI Bank. Therefore, the financial

statements under US GAAP and Indian GAAP for the Bank are not comparable and these differences are

expected to continue in future years. ICICI’s assets were fair valued while accounting for the merger under

Indian GAAP. The primary impact of the fair valuation was the creation of additional provisions against

ICICI’s loan and investment portfolio, reflected in the Indian GAAP balance sheet at March 31, 2002. Under

US GAAP, ICICI Bank’s assets were fair valued while accounting for the merger. There is also a difference in

the basis of computation of provision for restructured loans under US GAAP, which discounts expected

cash flows at contracted interest rates, unlike Indian GAAP, under which current interest rates are used.

Net income as per US GAAP increased 63.4% to Rs. 8.53 billion in fiscal 2005 from Rs. 5.22 billion in fiscal

2004 primarily due to a 27.2% increase in net interest income to Rs. 23.85 billion and a 74.2% increase in

fee income, offset, in part, by a 22.1% increase in operating expenses.

As a result of the significant differences in the basis of accounting under US GAAP and Indian GAAP, the

Bank’s US GAAP accounts showed a profit of Rs. 8.53 billion as compared to Rs. 18.52 billion under Indian

GAAP in fiscal 2005.

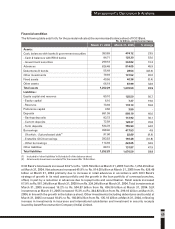

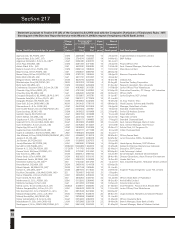

The following table sets out a condensed unaudited reconciliation of consolidated profit after tax as per

Indian GAAP with net income as per US GAAP for fiscal 2005.

(1) Certain items have been aggregated/ combined as considered appropriate.

(2) All amounts have been rounded off to the nearest Rs. 10.0 million.

Management’s Discussion & Analysis

ICICI Securities Limited

ICICI Prudential Life Insurance Company Limited

ICICI Lombard General Insurance Company Limited

ICICI Venture Funds Management Company Limited

ICICI Home Finance Company Limited

FY2005

0.64

(2.12)

0.48

0.32

0.10

FY2004

1.65

(2.22)

0.32

0.26

0.10

Rs. in billion

Audited consolidated profit after tax as per Indian GAAP

(1)

Adjustments :

Higher provision for restructured loans

Other higher provisions under US GAAP

Amortisation of debt issue cost and intangible assets

Unamortised loan origination cost written off on sale of assets

Deferred tax benefit

Net impact of fee and expense amortisation

Other adjustments

Audited net income as per US GAAP

18.52

(10.61)

(4.06)

(0.83)

(0.62)

4.04

2.67

(0.58)

8.53

Rs. in billion

Dickenson Tel: 022-2625 2282