ICICI Bank 2005 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2005 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

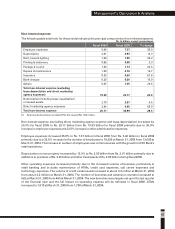

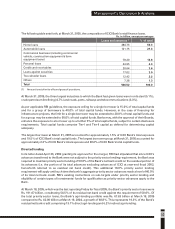

Total interest income (excluding dividend) increased 4.8% to Rs. 93.29 billion in fiscal 2005 from Rs. 89.03

billion in fiscal 2004 primarily due to an increase of 17.7% in the average interest-earning assets to

Rs. 1,153.24 billion, offset, in part, by a decline of 1.0% in yield on interest-earning assets. Yield on average

interest-earning assets decreased to 8.1% in fiscal 2005 from 9.1% in fiscal 2004 primarily due to

origination of new loans at lower rates given the reduction in our average cost of funding, and reduction in

higher-yield loans made in earlier periods. Interest income is net of commissions paid to direct market

agents for automobile loans. While the yield on average advances declined 1.3% to 9.4% in fiscal 2005, the

yield on average investments declined 1.0% to 6.4% in fiscal 2005.

Total interest expense decreased 6.3% to Rs. 65.71 billion in fiscal 2005 from Rs. 70.15 billion in fiscal 2004,

primarily due to a decline of 1.3% in the cost of funds offset, in part, by a 15.0% increase in average

interest-bearing liabilities to Rs. 1,138.25 billion. Cost of funds decreased to 5.8% for fiscal 2005 from 7.1%

for fiscal 2004 primarily due to the increased proportion of deposits in ICICI Bank’s funding on account of

repayments of higher cost borrowings of ICICI as well as a reduction in the cost of deposits to 4.5% from

5.4%. Total deposits at March 31, 2005 constituted 70.5% of ICICI Bank’s funding (comprising deposits,

borrowings and subordinated debts) compared to 63.1% at March 31, 2004.

As a result of the 1.3% decline in the cost of funds, offset, in part by a 1.0% decline in yield on average

interest-earning assets, net interest margin increased to 2.4% for fiscal 2005 from 1.9% for fiscal 2004. Net

interest margin is, however, expected to continue to be lower than other banks in India until the borrowings

of ICICI are repaid. The net interest margin is also impacted by the relatively lower net interest margin

earned by overseas branches, which is offset by the higher fee income that the Bank is able to earn by

leveraging its international presence and its ability to meet the foreign currency borrowing requirements

of Indian companies.

Fee income

Fee income increased by 78.6% to Rs. 20.98 billion in fiscal 2005 from Rs. 11.75 billion in fiscal 2004

primarily due to growth in fee income from retail products and services, including fees arising from retail

asset products like home loans and credit cards and retail liability-related income like account servicing

charges, and an increase in transaction banking fee income from corporate clients. During fiscal 2005,

retail banking operations contributed about 54.8% of total fee income, corporate banking operations

contributed 38.1% and international operations contributed the balance 7.1%. Fee income includes

merchant foreign exchange income amounting to Rs. 1.77 billion in fiscal 2005 and Rs. 0.90 billion in fiscal

2004.

Lease & other income

Lease income (including profit/ (loss) on sale of leased assets) decreased by 5.0% to Rs. 4.01 billion in fiscal

2005 from Rs. 4.22 billion in fiscal 2004 mainly due to a reduction in lease assets since ICICI Bank is not

entering into new lease transactions. ICICI Bank’s total lease assets were Rs. 14.53 billion at March 31, 2005

compared to Rs. 16.63 billion at March 31, 2004. Other income increased by 33.8% to Rs. 2.06 billion for

fiscal 2005 compared to Rs. 1.54 billion for fiscal 2004, primarily due to higher dividend income from

subsidiaries.

Management’s Discussion & Analysis

Dickenson Tel: 022-2625 2282